October 6, 2025

How to Maximize Your Resy Credits

Pam

For frequent diners, American Express® has quietly transformed Resy into more than just a restaurant reservation platform—it’s now a way to get a “free” meal. However, like many credit card benefits, Resy credits can be confusing or underutilized unless you understand exactly how they work. Let’s break it down and talk about how to maximize your Resy credits.

What Are Resy Credits?

Resy credits are statement credits tied to certain American Express® cards. First, it’s critical to note that you need to enroll to recieve the Resy benefits. After you’ve enrolled in the benefit, when you use an eligible card at a participating restaurant, Amex will reimburse part of the charge back to your statement up to a certain amount per specified time period, depending on which card you’re using. Eligible Resy purchases include purchases made directly from U.S. restaurants that offer reservations on Resy.com and the Resy app and accept American Express® Cards, purchases made directly on Resy.com or in the Resy app, and purchases made via Resy Pay. You don’t have to make a reservation through Resy, but the restaurant has to be in the Resy network.

In short: it’s money back for dining, but only if you use the right card in the right place.

Enrollment required. Terms apply.

Which Credit Cards Offer Resy Credits?

Several premium Amex cards now include dining credits specifically for Resy:

card_name – Up to $400 annually ($100 per quarter) in statement credits.

card_name – Up to $100 annually, split into two semiannual statement credits of up to $50 each (Jan.–June & July–Dec.).

card_name – Up to $120 annually ($10 monthly) in statement credits.

card_name – Up to $240 annually ($20 monthly) in statement credits.

Common Frustrations

While the credits look great on paper, many cardholders run into the same issues:

- Use-it-or-lose-it: Credits don’t roll over. Miss the month or quarter, and the value disappears.

- Eligibility limits: Only restaurants within Resy’s platform qualify—not every restaurant you love will count.

- Enrollment hurdle: Don’t forget to enroll in this benefit in your American Express® account.

- Tracking overload: With multiple cards offering different credits, it can feel like a juggling act.

How to Make Using Resy Credits Easier

- Enroll first. Log into your Amex benefits portal and activate your Resy credit before dining. This is vital.

- Automate reminders. Add recurring calendar events for when monthly or quarterly credits reset.

- Plan around natural spending. Book restaurants you’d go to anyway, rather than forcing yourself to use credits. Although, this is a great way to try out a new spot!

- Keep it simple. If tracking multiple cards is overwhelming, stick with one card where the dining perks align best with your lifestyle.

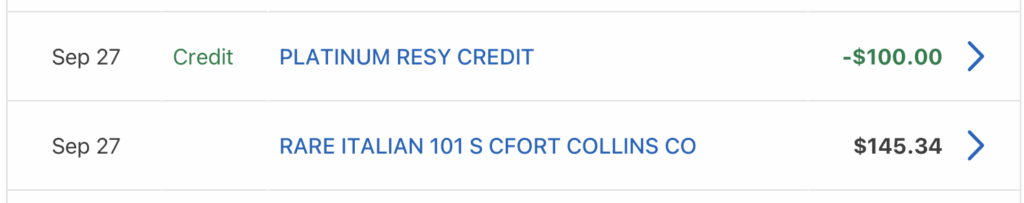

This is a restaurant I visit often so the fact that it is a Resy restaurant is a win-win for me.

Buying Resy Gift Cards

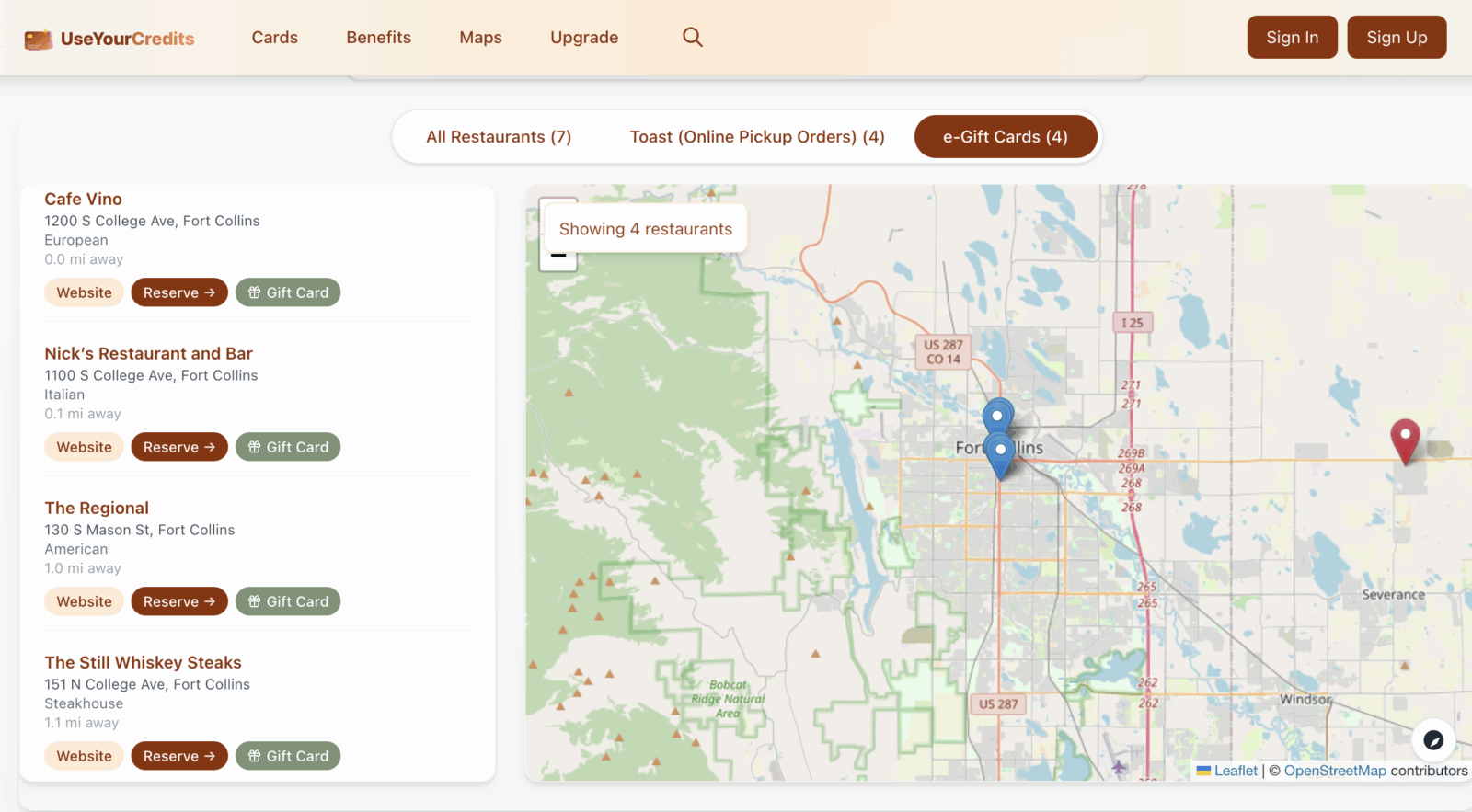

Our resident Crime Dog, Jess, found a site that discusses buying Resy gift cards with your credits. This is a good strategy if you don’t have a Resy dining establishment near you, but you can use one when you travel. Plan on buying gift cards to use later on when you’re on a trip and can make it to that restaurant! But take note that the terms and conditions say that gift cards purchased at restaurants “may not receive the statement credit.” Assuming the site is reliable, it should indicate which restaurants should theoretically will lead to a statement credit.

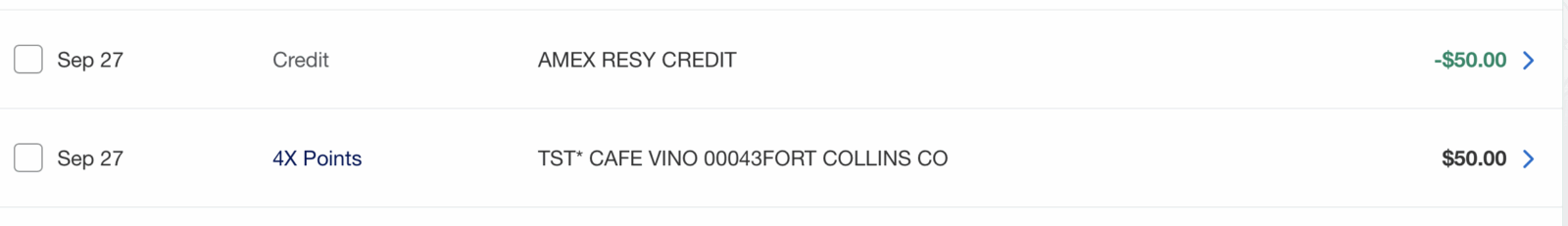

I checked it out with restaurants in my area. While my favorite restaurant to use the Resy credit at doesn’t offer the gift card option, four others do. I bought an e-gift card to one and it credited perfectly!

Yeah! My gift card purchase worked!

Bottom Line

Resy credits can be a genuine value—easily offsetting annual fees on premium cards—but only if you actually use them. By syncing the benefit with your regular dining habits and setting simple systems to remind you of resets, you can turn a perk that could be frustrating into one that consistently works in your favor. I’m pretty excited about all this new “almost free” dining that I can use!

Tip: Before making a reservation, double-check that the restaurant is on Resy’s platform, and always pay with the enrolled card. That one small step ensures you’ll actually see the credit hit your account.

Opinions, reviews, analyses, and recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply.

Related Posts

Review of American Express Platinum Card®

Changes to American Express Platinum Card®

Changes to the Business Platinum Card® from American Express

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.