October 13, 2020

All About Wyndham Credit Cards

Pam

Today let’s talk all about Wyndham credit cards. Sure, many of the hotels aren’t as fancy in general as those offered by Marriott, Hilton, Hyatt, and IHG but I’ve stayed at them. When I fly out of an airport at zero dark-thirty, I prefer to stay near the airport. I definitely don’t need luxury then. Just about anything clean and safe will do. I have really enjoyed not having to pay for that kind of stay because of the points I had with my Wyndham credit card.

Recently Barclay Bank revamped their Wyndham credit cards. They now have two personal credit cards and one business credit card. Let’s go over them!

Wyndham Rewards Earner

When you apply for this new card and spend only $1,000 in the next 3 months, you will get 30,000 Wyndham Rewards. Some Wyndham hotels start at 7,500 points so you could get 4 free nights after meeting your minimum spend. The great thing is that there is no annual fee to this card! It also comes with Wyndham Gold status as long as you have the card. This is what that will get you:

- Late checkout when available

- 10% point-earning bonus

- Free wifi

Additionally, there are no foreign transaction fees. You will also get 7,500 Wyndham Rewards on each anniversary that you spend $15,000 on this card. You have to spend that $15,000 though so not such a great deal, in my opinion. If I applied for it, I’d just go for the bonus spend and put it in my sock drawer.

You get the following return on spending with this card:

- 5x Wyndham points on Wyndham spending and gas stations

- 2x Wyndham points on dining and groceries

- 1x Wyndham points on all other purchases

Wyndham Rewards Earner Plus

You can earn 45,000 Wyndham Rewards after you spend only $1,000 in 90 days. The difference is that you do have to pay an annual fee of $75. You will definitely get an extra free night for that $75 and that seems to be worth the annual fee. You will also get Wyndham Platinum Status as long as you have the card and that will get you:

- Late checkout when available

- Early check-in when available

- 15% point-earning bonus

- Free wifi

- Free upgrade on rooms, as available

The anniversary points bonus also is 7,500 with this card – basically a free night. But with this card, you don’t have a spending requirement. For this reason, I like this card better. You also get the following return on spending with this card:

- 6x Wyndham points on Wyndham spending and gas stations – great card for gas stations if you value Wyndham Rewards!

- 4x Wyndham points on dining and groceries

- 1x Wyndham points on all other purchases

Wyndham Earners Business Card

Wyndham did not have a business card prior to the unveiling of this card. The annual fee on this card jumps to $95 and you get the same 45,000 after a $1,000 spend in 3 months. The big difference is you get twice as many points, 15,000, on your anniversary. You also jump to Diamond status as long as you have the card. This will get you:

- Late checkout when available

- Early check-in when available

- 20% point-earning bonus

- Free wifi

- Free upgrade on rooms, as available, including suites

- Welcome amenity (usually food or beverage)

You get the following return on spending with this card:

- 8x Wyndham points on Wyndham spending and gas stations – great card for gas stations if you value Wyndham Rewards!

- 5x Wyndham points on eligible marketing, advertising services, and utilities

- 1x Wyndham points on all other purchases

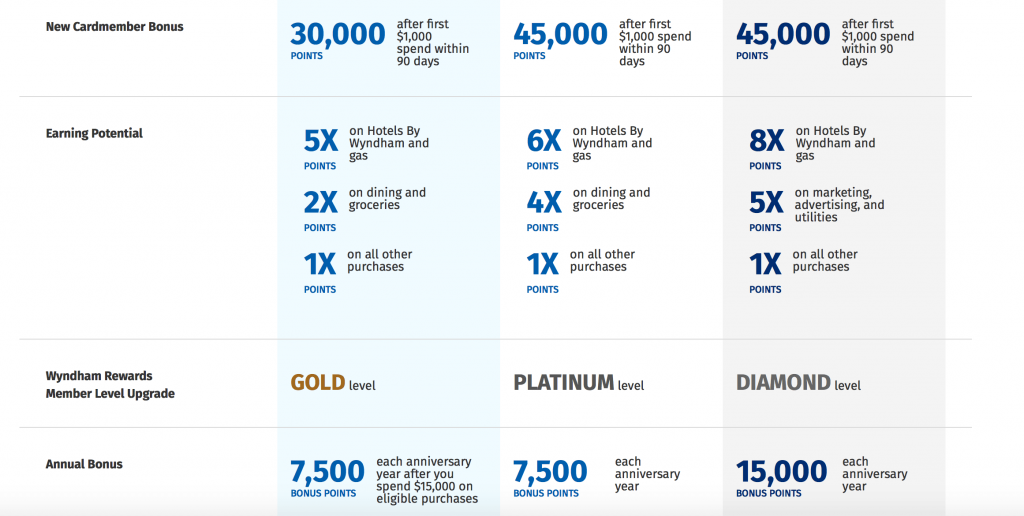

Comparison of Wyndham Credit Cards

Hotels in the Wyndham Chain

Again, Wyndham Hotels are not the fanciest but they make a great stay for a family on a budget or a quick night when traveling. And getting them for free is always a win-win! The following hotels are included in the Wyndham chain:

- La Quinta

- Days Inn

- Howard Johnson

- Super 8

- Wyndham Grand – some great options here!

- Baymont Inn & Suites

- AmericInn

- Travelodge

- Ramada

Possible Redemptions

Let’s say I want to go to Clearwater, Florida. (A great place to visit this winter!) I can find rooms that range from 7,500-30,000 Wyndham Rewards needed to book.

Here’s a 30,000 reward property, the Wyndham Grand Clearwater Beach. It looks pretty nice but I will use up most of my points on it for a one night stay.

If I’m going to the beach, I’ll be spending most of my time outdoors, so I think I’d rather spend fewer points. Let’s look at the La Quinta Inn by Wyndham Clearwater Central. I can stay here for just 15,000 Wyndham Rewards a night and we will get free breakfast! I can get two double beds also.

One of my favorite redemptions for Wyndham hotels is when I fly out of Denver super early. I have stayed at the La Quinta Denver Airport for 15,000 points.

Bottom Line

There are definitely some good 15,000 Wyndham Reward redemptions. I think I may pass on the 7,500 redemptions. I will definitely sign up for the Wyndham Rewards Earner Plus because I find definite value in staying at their hotels for a short stay near the airport. Getting a free hotel and getting to sleep in longer before I fly out on an early flight is definitely worth getting this Wyndham credit card. I can easily put $1,000 minimum spend on the card so it is a no-brainer for me!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.