September 8, 2021

American Express Lifetime Rule

Pam

American Express Credit Cards have a “once per lifetime” rule. That means that “usually” you can only get one of their welcome offersonce in a lifetime per card. This makes it really important to apply for one of their cards when the welcome offer is at an all-time high.

We love American Express Membership Rewards®, the bonus points that you get with American Express credit cards like card_name card_name, and the American Express Green Card®. They are transferable points, which means they can be transferred to the airlines and hotels that Amex partners with. These include:

- Aeromexico

- Air Canada

- Air France

- KLM

- Alitalia,

- ANA

- Cathay Pacific

- British Airways

- Delta

- Emirates

- Etihad

- Iberia

- JetBlue

- Qatar Airlines

- Qantas Airlines

- Singapore

- Virgin America

- Virgin Atlantic

- Hilton

- Choice

- Marriott

Exceptions to the Lifetime Rule

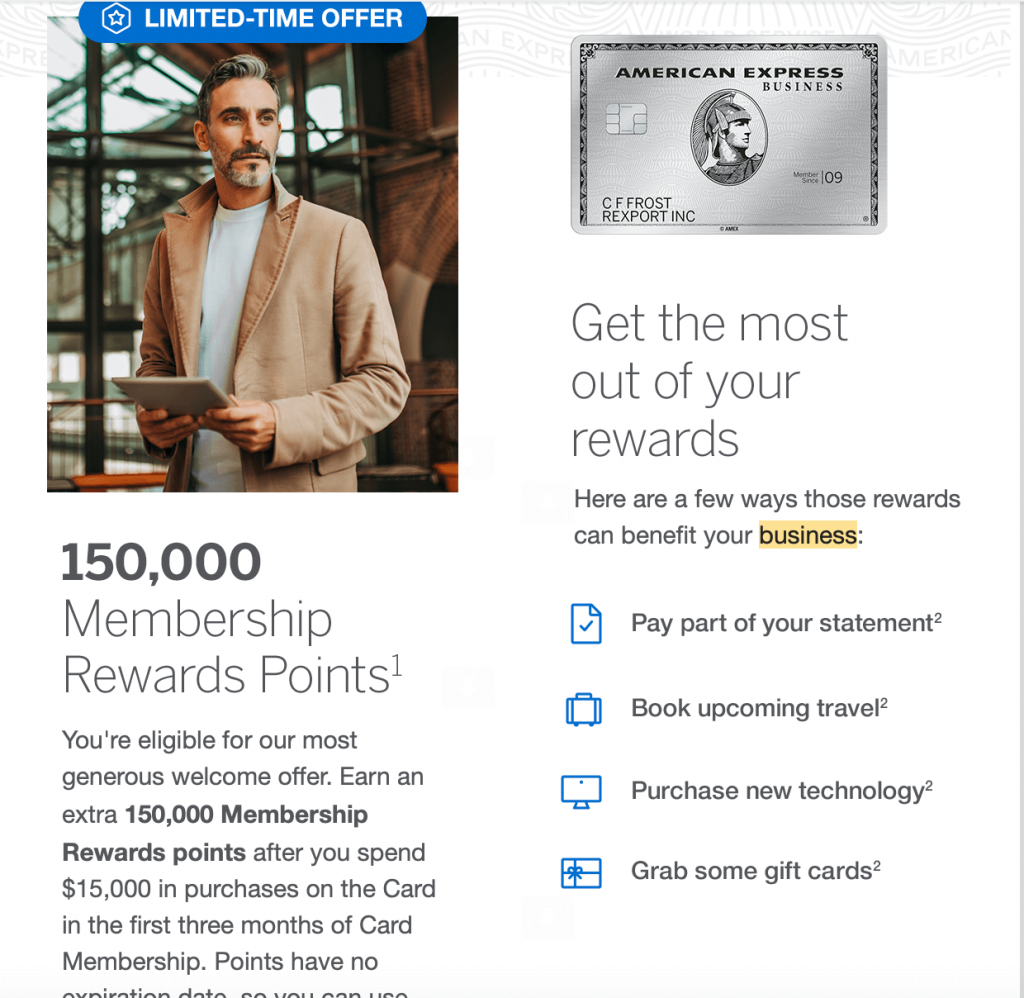

Occasionally, you might get an offer for an Amex credit card that doesn’t have the lifetime rule in its terms and conditions. This doesn’t happen that often, but it does happen. I’ve been looking for one for some time and finally got one. I have card_name for my small business. Earlier this year, I was offered that card again. I totally expected to see a pop-up bubble saying I wouldn’t get the bonus signup when I applied, but I didn’t.

I received an email offering this, and I initially thought it was a mistake since I already had the card. I read on other sites that people were getting it again, so I decided to apply.

150,000 Membership Rewards is a great bonus. This equals at least 165,000 Membership Rewards after meeting the minimum spend, and I can use that towards an international flight I was planning on the card. I was immediately approved for the card. That was a big minimum spend, but we were able to use it to pay my husband’s estimated taxes (he’s self-employed), which worked out great.

Reportedly, after about 7 or so years, the lifetime rule ends. I guess it really isn’t a lifetime rule but more of a 7+year rule. Some people claim that American Express “forgets” you had the card about 7 years after canceling it. If you give this a try and aren’t eligible, you’ll get a pop-up that will let you know. From there, you can cancel the application. Some have even had success with this before the 7 years.

Bottom Line

In the meantime, make sure you sign up for American Express cards when they have a great welcome offer, and keep a lookout for American Express signup offers that don’t have the lifetime rule. You may get lucky, as I did, and get the welcome offer again! Have you ever gotten an American Express welcome offer more than once?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I know this is an older post, but as more of beginner points/miles mom I had a question about business cards bonuses and the example you posted above with the Amex Business Platinum. If you already held a Amex Business Platinum with your personal small business and received the targeted offer for the Amex Business Platinum with sign up bonus, are you using a different business name? Curious how this would work for people who apply for business cards with their SSN as a sole proprietor (those only with small side gigs) and do not have a separate business with LLC/EIN etc. Thank you in advance if you see this question and are able to answer.

If you get the targeted offer for another card, you can apply in the exact way you applied before.