July 10, 2025

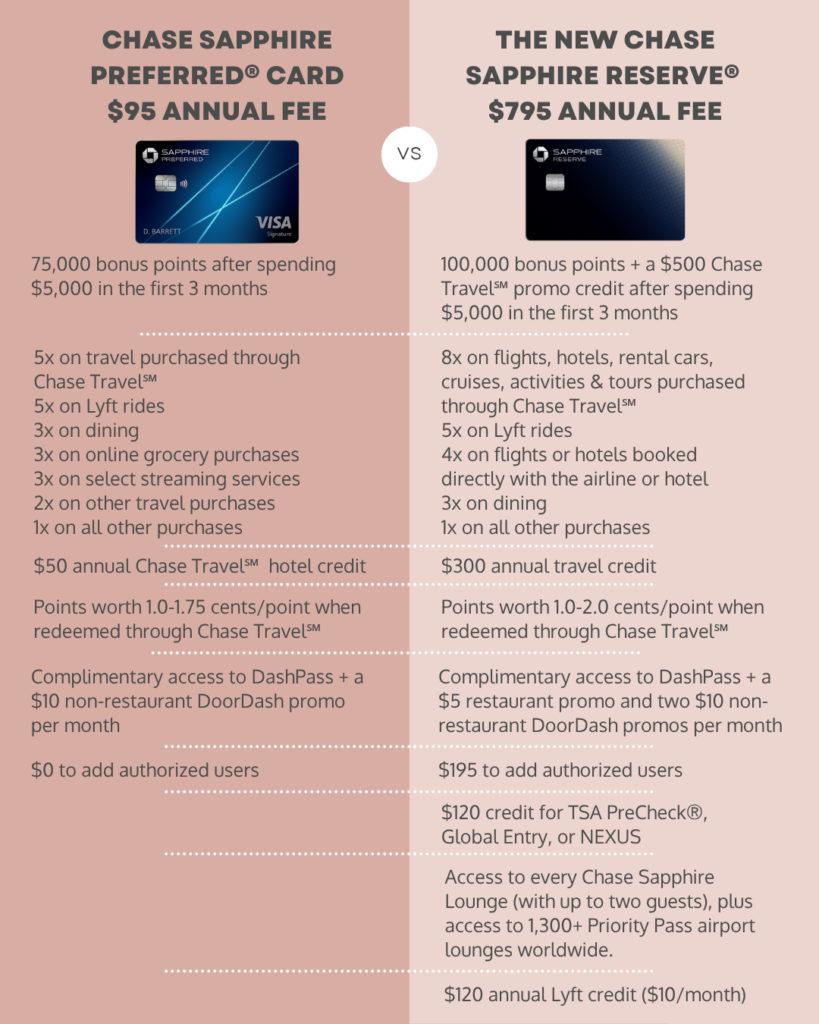

Chase Sapphire Preferred® Card vs. Chase Sapphire Reserve®

Alex

The card_name and the card_name are two of the most popular cards for people who use credit card points and miles. Both of these cards earn Chase Ultimate Rewards®, which we love! These points are great because they are so flexible. You can use them at Chase Travel℠ (similar to Expedia) and book just about any type of travel, or you can transfer the points directly to one of Chase’s many hotel and airline partners and book directly. In this post, we will go over each of these cards and share which one we recommend you start with. Let the battle of the Chase Sapphire Preferred® Card vs. Chase Sapphire Reserve® begin!

Chase Sapphire Preferred® Card

We probably recommend this card the most because it offers wonderful transferable points (Ultimate Rewards®), and the annual fee is low. And one thing that’s also great is that you can combine your points.

Learn How to Apply

bonus_miles_full

Card Details

The Chase Sapphire Preferred® Card has an annual fee of $95. You’ll receive an annual $50 hotel credit when you book a hotel via Chase Travel℠. You can earn 5 points for each dollar spent when booking through Chase Travel℠ or Lyft rides. You’ll also earn 3 points per dollar spent on restaurants, online grocery orders, and streaming services. Additionally, you can earn 2 points per dollar on travel purchases and 1 point per dollar on all other expenses.

We’ve used Ultimate Rewards® to book the Ziva Cancun several times!

Chase Sapphire Reserve®

The card_name is a luxury Ultimate Rewards® card with a hefty annual fee of $795, but it has some great benefits to offset that.

Learn How to Apply

bonus_miles_full

Card Details

The Chase Sapphire Reserve® has an annual fee of $795 but comes with a $300 annual travel credit. You’ll also get a statement credit to cover TSA PreCheck®, Global Entry, or NEXUS every four years. As mentioned above, this card includes access to select airport lounges, and two guests can get into lounges with you at no extra cost, as well. When it comes to earning points, you can earn 8 points per dollar spent on hotels, flights, cruises, activities, tours, and rental cars booked via Chase Travel℠. You also earn 4 points per dollar on flights and hotels booked directly, 5 points per dollar on Lyft, and 3 points per dollar on dining. All other purchases earn 1 point per dollar spent.

Other benefits include:

- Complimentary access to DoorDash DashPass plus a $5 restaurant promo and two $10 DoorDash non-restaurant promos per month.

- $120 annual Lyft credit ($10/month).

- Includes Priority Pass Lounge membership. You know how we love our airport lounges! Also unlimited entry into Chase Sapphire Lounges®, which are really nice. This card makes lots of sense if you have one in your airport!

- $500 annual credit for The Edit through Chase Travel℠ ($250 semiannually).

- $300 annual credit for Sapphire Reserve® Exclusive Tables ($150 semiannually).

- $120 annual credit for Peloton subscriptions ($10/month).

- $300 annual credit for StubHub purchases ($150 credit Jan. through Jun. + $150 credit Jul. through Dec.).

Redeem your points for a stay in Hawaii by transferring Ultimate Rewards® to Hyatt.

Can You Have Both Cards?

- You can now hold both the card_name and the card_name, and you may be eligible to earn the welcome offers on both.

- Chase is moving towards a pop-up model (similar to American Express) when it comes to eligibility. When you click “submit” on an application, Chase will do an internal check to see if you are eligible for the welcome offer before a soft or hard pull takes place. You can then decide whether you want to move forward based on the message you receive.

Which Card Should I Get?

The Sapphire Reserve has a higher annual fee (but great benefits to offset it). While we usually recommend that beginners start with the Sapphire Preferred, some arguments exist for taking advantage of the Reserve, such as if it offers a higher welcome offer than the Preferred or if you want the benefits that come with having the Reserve.

Bottom Line

So who wins in the battle between the Chase Sapphire Preferred® vs. Chase Sapphire Reserve®? You do! Because both cards offer great options for earning our favorite type of points, and you can pick which card will get you the most value for the way you like to travel. The Chase Sapphire Preferred® Card usually gets our nod as a good option for everyone because of the lower annual fee, but the Chase Sapphire Reserve® offers some key benefits that make it a better choice for some travelers. Which card do you prefer, and why?

Related Posts

How to Combine Chase Ultimate Rewards® Points

Points Boost by Chase: What You Need to Know

Review of the Chase Sapphire Lounge in Boston

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.