September 11, 2025

Free Travel with Savewise

Pam

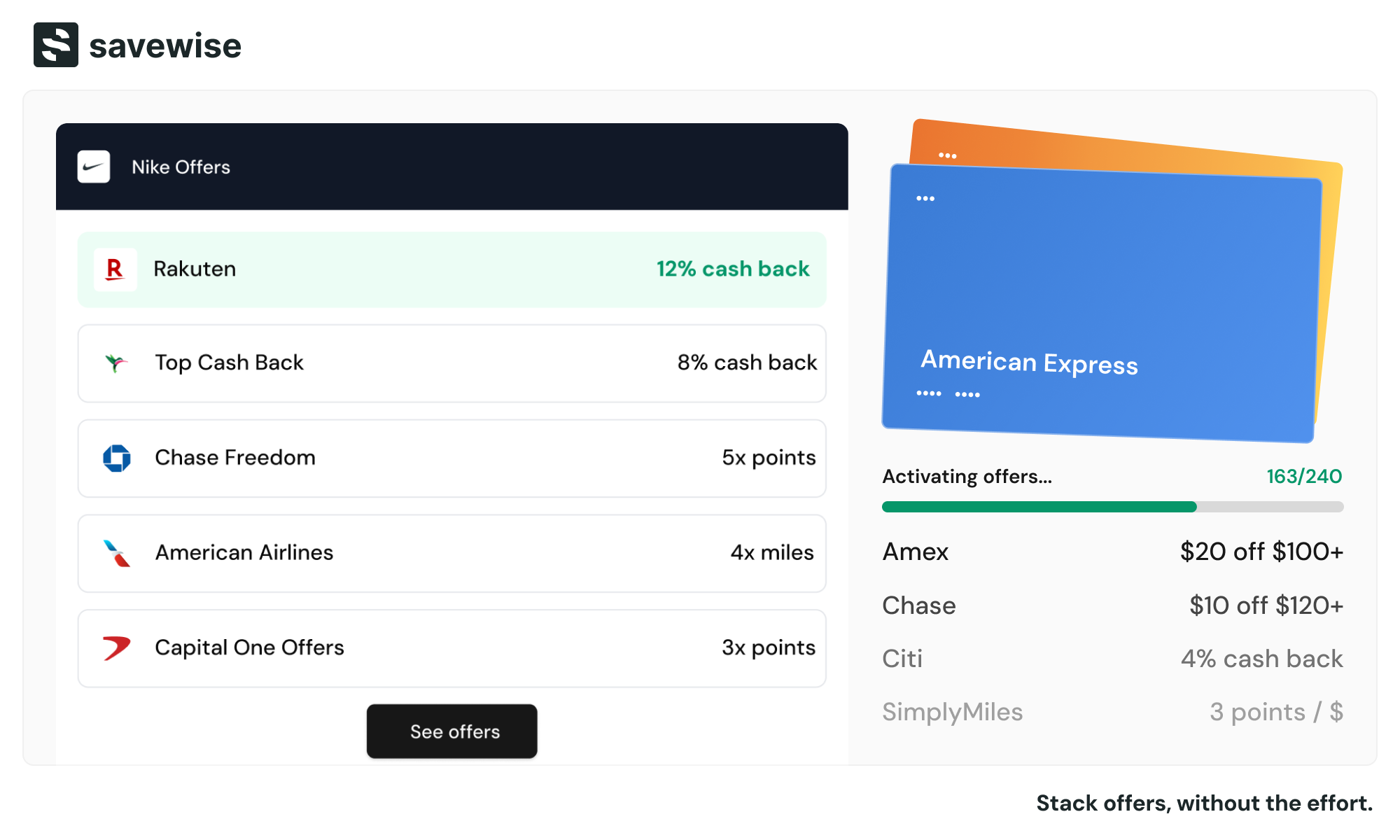

If you’re already using points and miles to stretch your family’s travel budget, you know the thrill of finding ways to earn a few extra points and miles. Keeping track of which shopping portal has the best deal, which card-linked offers are active, and whether it’s even worth stacking an offer can feel overwhelming. That’s where earning points for free travel with Savewise comes in.

Savewise is a tool that can help you maximize rewards on everyday purchases by showing you which portals and offers will yield the biggest return before checkout. Instead of juggling multiple tabs and second-guessing whether you’re earning the most rewards, Savewise shows it all in one dashboard. I’m not sure about you, but that sounds like a winner to me!

How Savewise Works

Unlike a traditional shopping portal, Savewise doesn’t issue cashback or miles directly. Instead, it acts as a personal comparison engine. When you search for a retailer (say Target, Sephora, or Nike), Savewise instantly shows you:

-

Which shopping portals are offering the best rates (like Rakuten, TopCashback, or an airline portal).

-

Which card-linked offers are available for your Chase or American Express cards.

-

Compare the current rate to historical averages to determine whether it’s worth waiting to shop on another day.

This means you can easily spot when it makes sense to click through Rakuten for cash back, when to use an airline portal to boost your miles balance, or when to stack a credit card offer on top of it all for maximum value. And to be honest, stacking is something I haven’t done much of, as it seems like too much work, but this could make me a believer!

Key Features Families Will Love

Here are some features that make it a great tool:

-

Browser Extension – When you land on a retailer’s website, Savewise pops up automatically to show you the best options available.

-

Offer History – See how cash-back or points rates have changed over the past weeks and months so you can time your purchases strategically. I love this to help me decide if this purchase is the best right now or whether I should hold off for a bit.

-

Alerts – Set up reminders for your favorite stores so you’ll be notified when a stores’s cash-back or points offer hits your desired level.

This means spending less time researching and feeling more confident that every online purchase is working harder for you. Save time AND get the best deal? Sign me up!

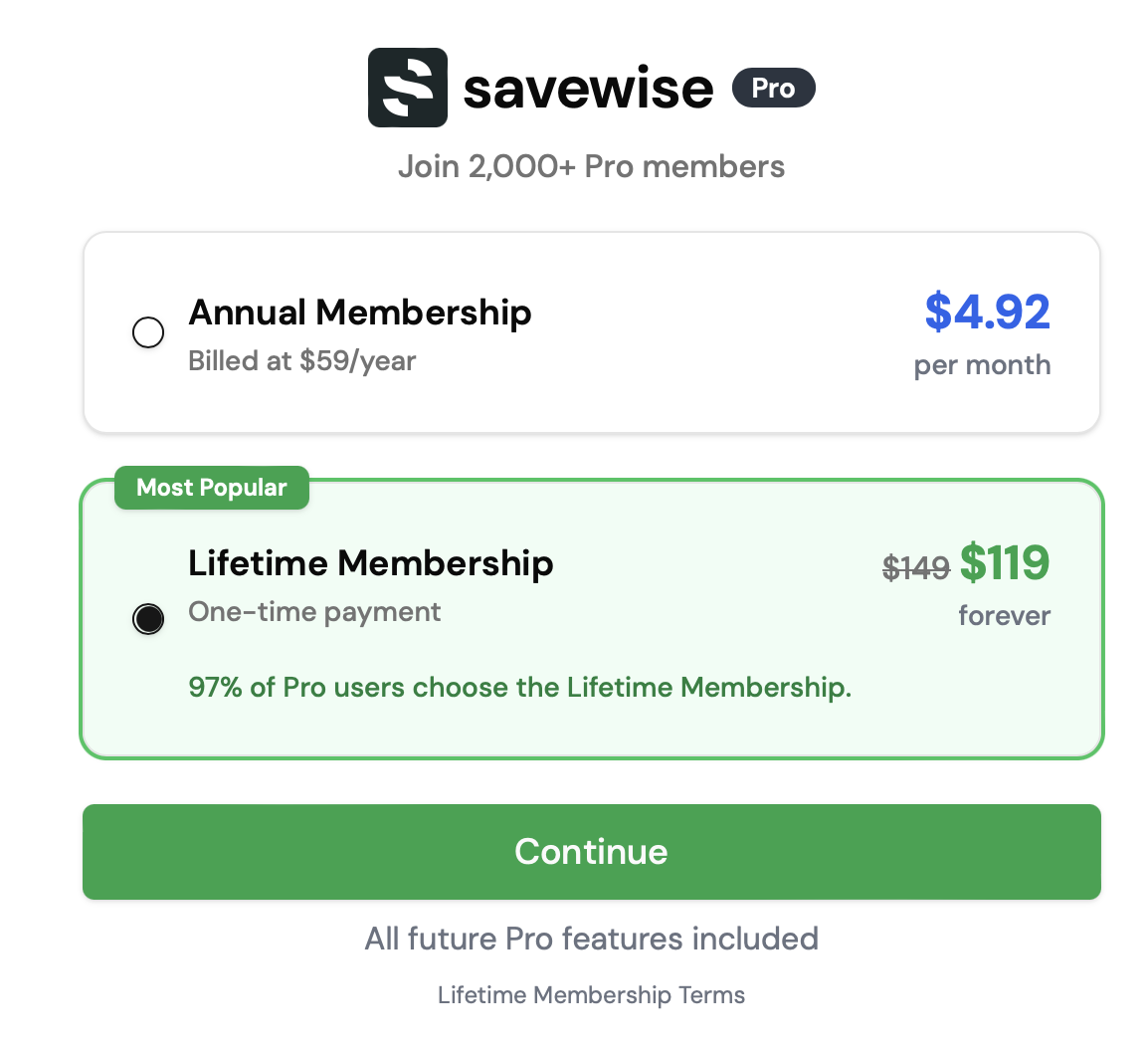

Free vs. Pro: Which Do You Need?

Savewise offers both a free plan and a Pro plan. Which works best for you?

-

With the free plan, you’ll get portal comparisons, public card offer listings, a limited view of offer history, and the ability to set up to three alerts at a time.

-

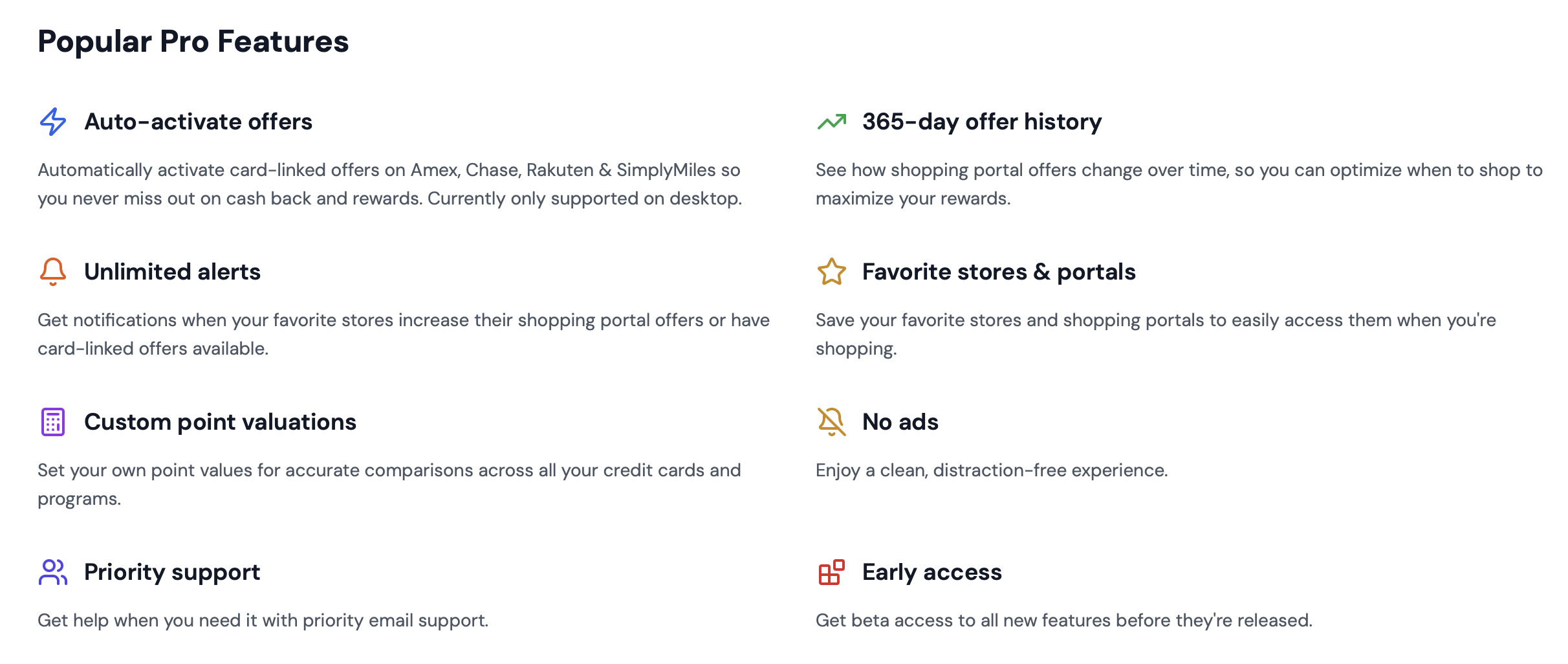

The Pro plan unlocks deeper features like auto-activation of Chase and Amex offers, a longer 365-day offer history, unlimited alerts, and the ability to customize how you value points and miles.

If you’re serious about maximizing every dollar, Pro is a no-brainer. But even the free version is a fantastic starting point.

Why Savewise Matters for Travel

Every mom who travels with her family knows—every dollar counts. Savewise can turn normal online shopping into a strategy to earn more points and more miles. That means groceries, school clothes, holiday gifts, or even that occasional splurge-worthy new purchase can bring you closer to your next family trip. With Savewise, you’re not leaving rewards on the table—you’re stacking them and maximizing them without a lot of extra work on your part—even better!

Savewise Real-Life Example

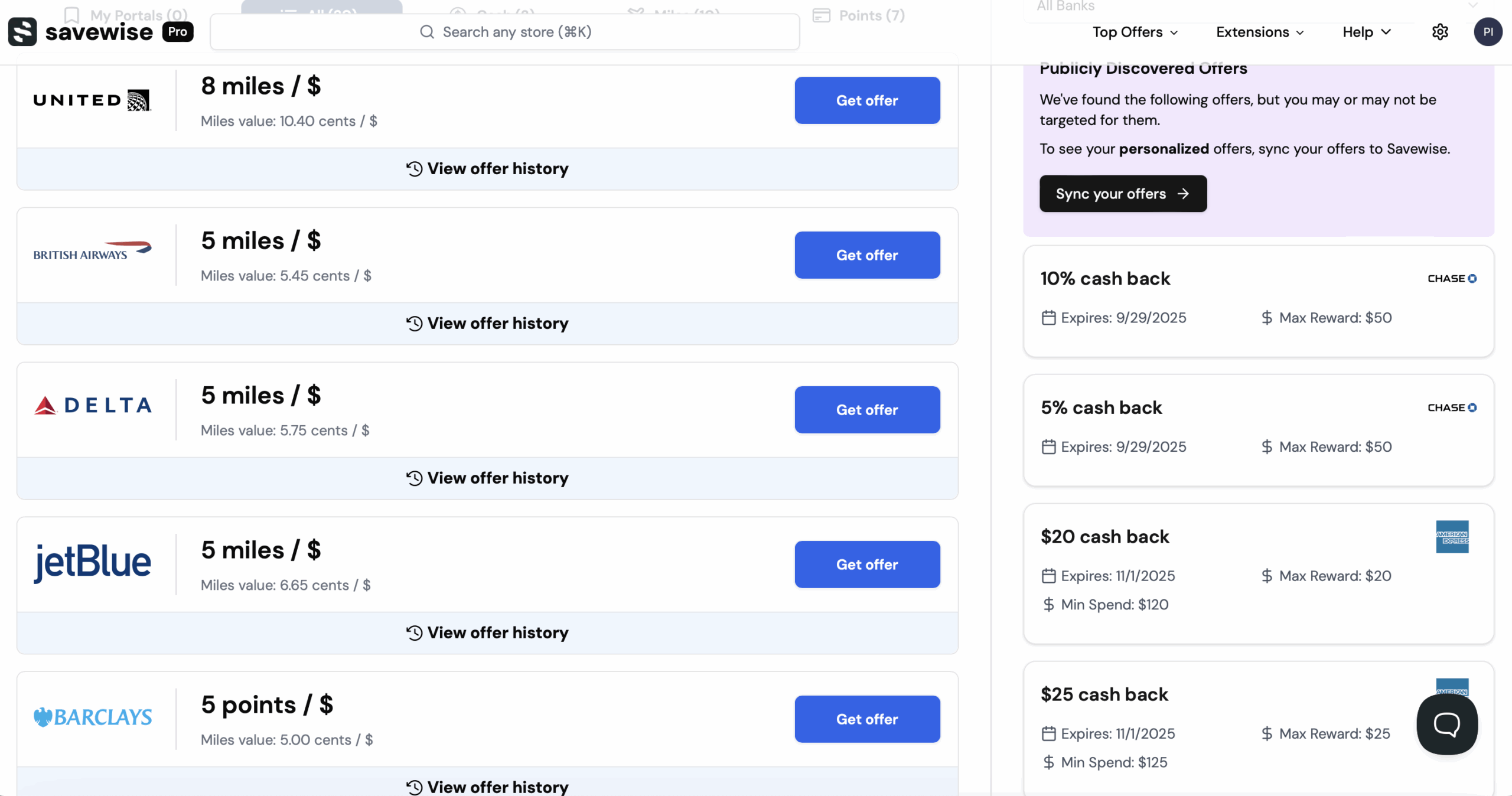

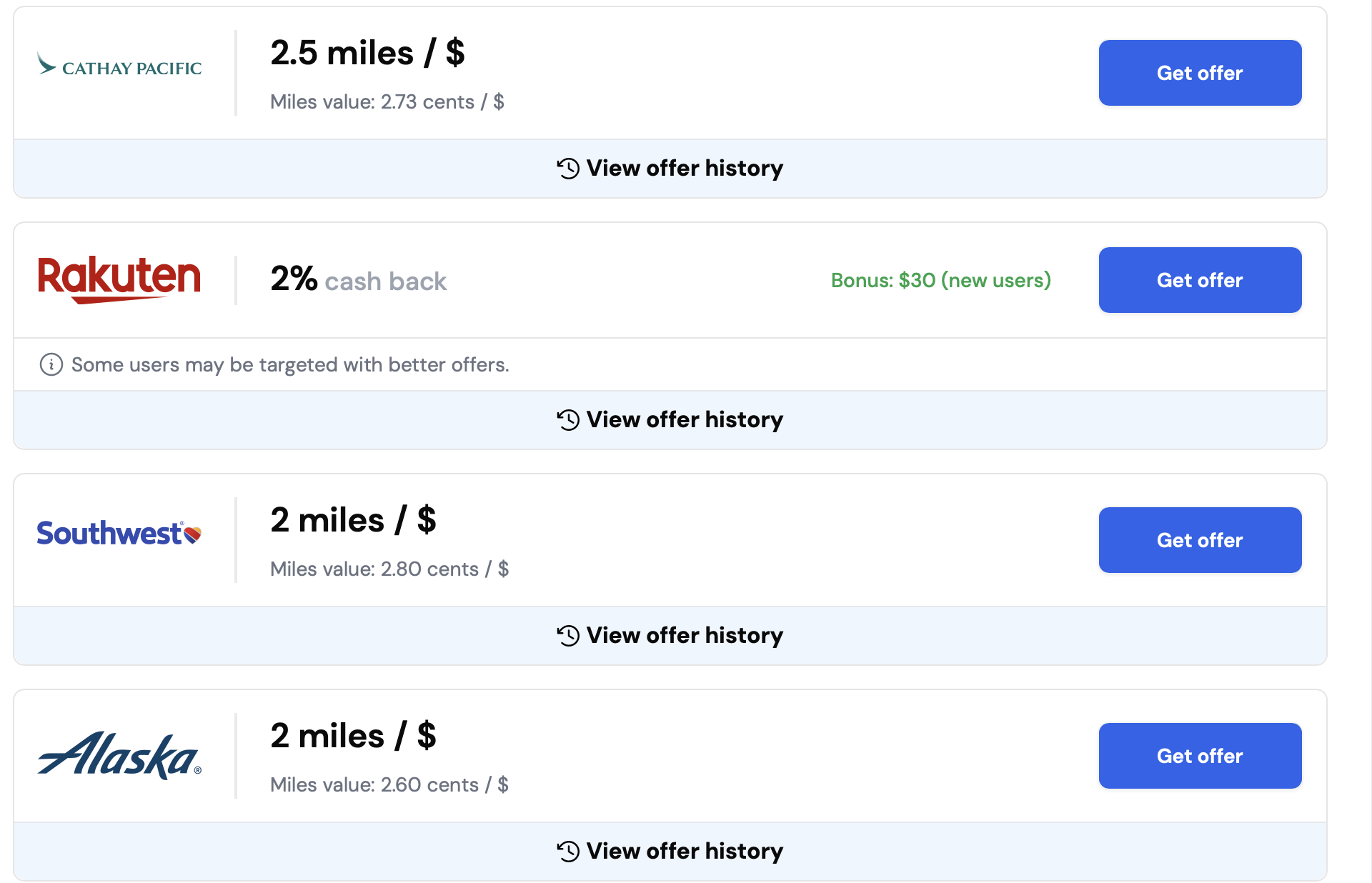

I love Lululemon, and I’d like to make a purchase from there. On the dashboard, I type in “Lululemon,” and these are the results I find.

This shows me so many options:

- I can book on Rakuten and earn 2% American Express Membership Rewards® on my purchase.

- Shopping through the United Airlines portal will give me the largest amount of points for my purchase (but they are not my favorite way to earn points).

- The Capital One portal will earn 4 points per dollar spent, which is a better deal for me since I frequently use Capital One Venture Miles.

- Not only can I get an offer through a portal, but I can also stack it with a credit card offer, as shown on the right side. This makes my thoughts of using Rakuten and an Amex offer even more compelling.

Am I Getting the BEST Offer Today?

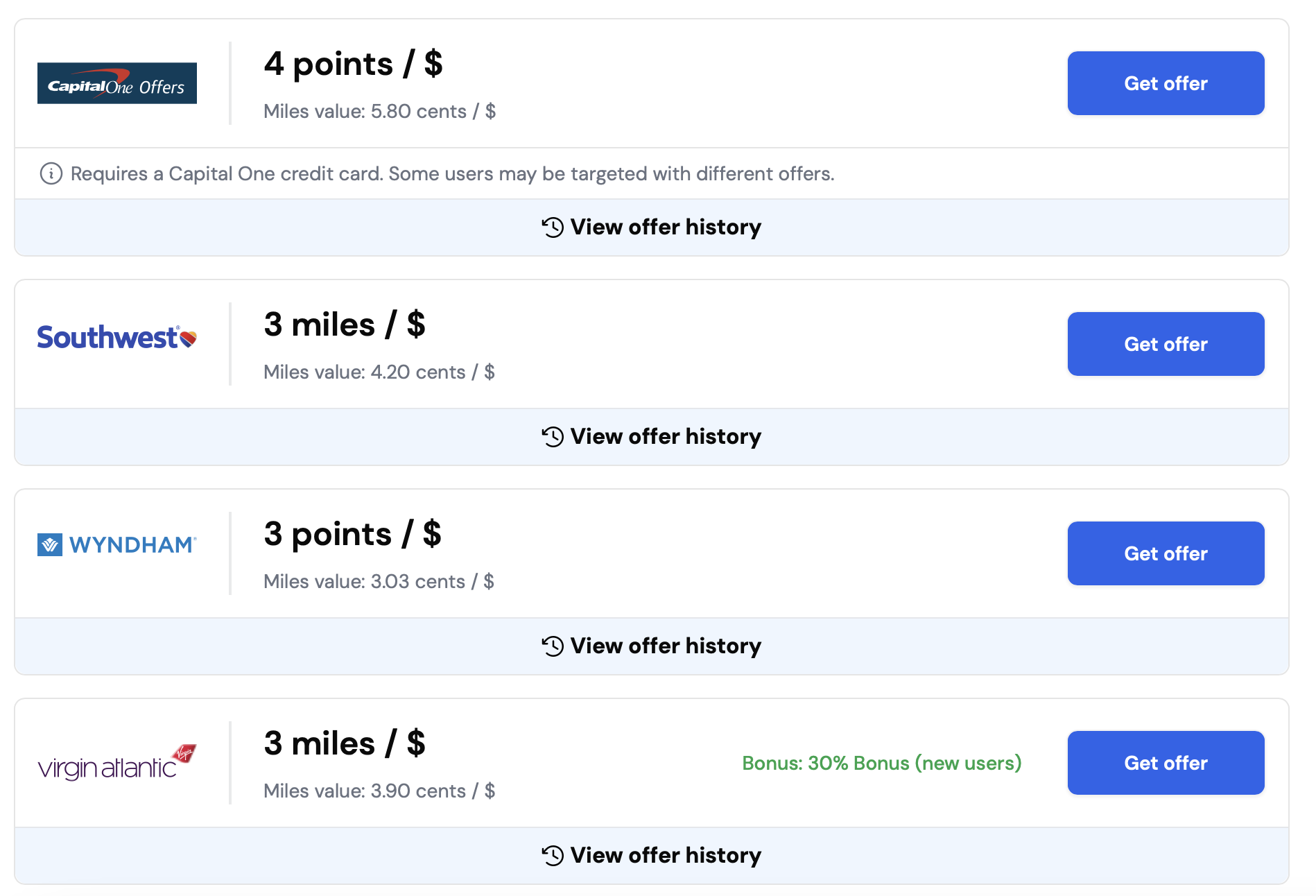

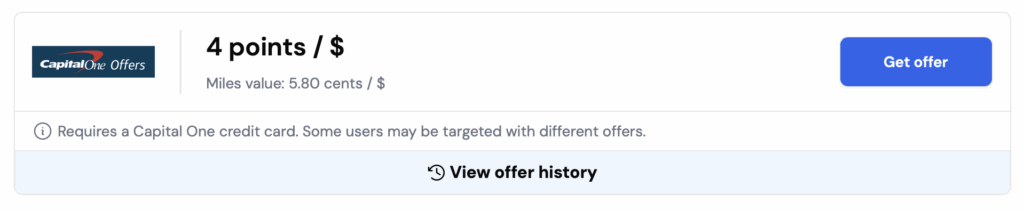

If I don’t need to place my Lululemon purchase right away, I might want to review the order history and see if I can wait and get more savings later. Let’s check it out.

Under the store name is an offer history tab. Select that to see a history of offers. I’m checking the Capital One shopping portal history.

Here is the 14-day history—looks like I might wait for a better deal!

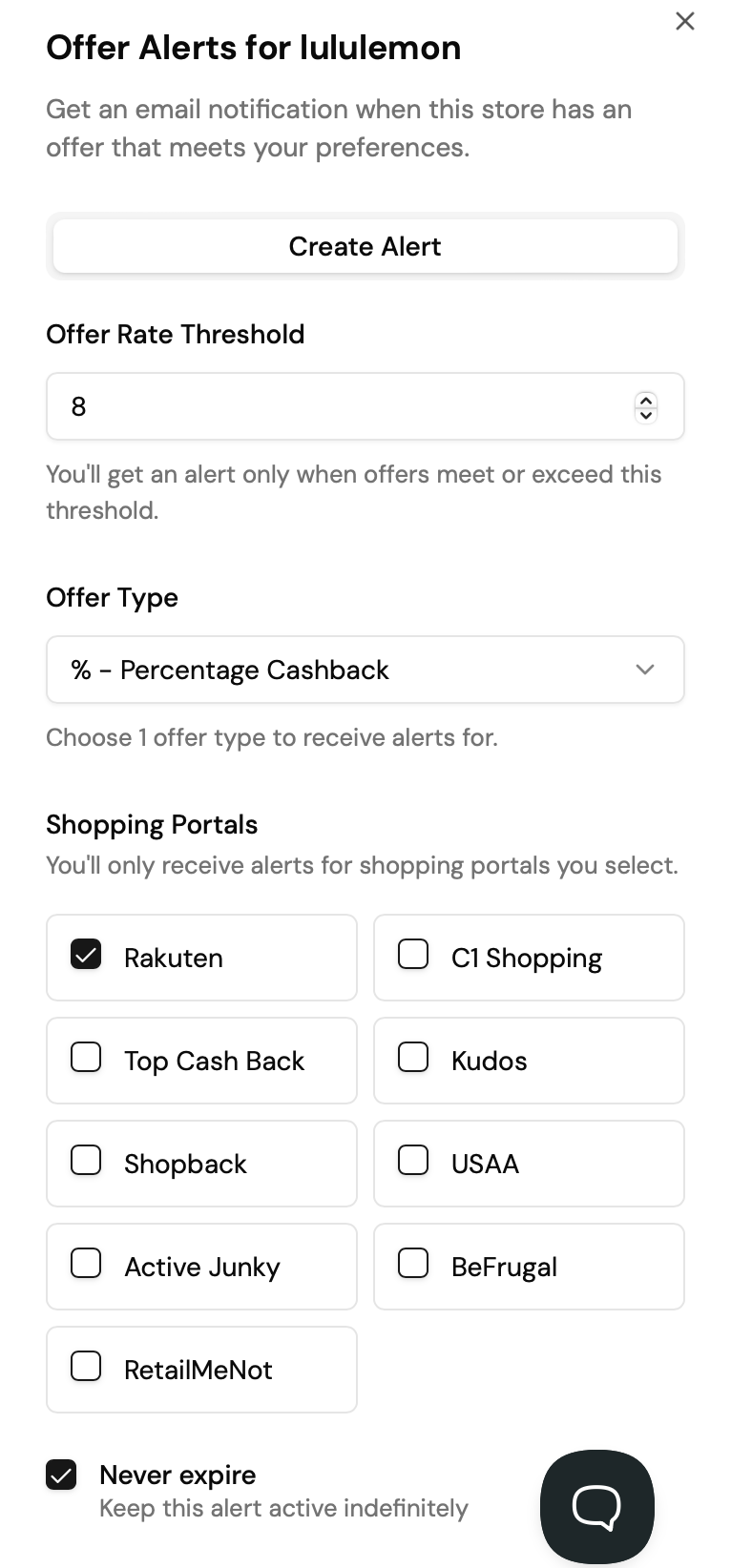

Now, I don’t want to check the offer every day until it returns to 8%, so I can set an offer alert. Let’s do it! I select the “Set Alerts” tab.

Here’s my filled-out alert. I picked an indefinite alert and will cancel it after I find the offer. I could set an expiration date if I wanted to.

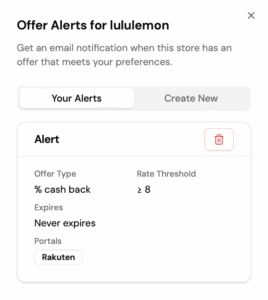

Here’s my alert now.

Stacking Offers

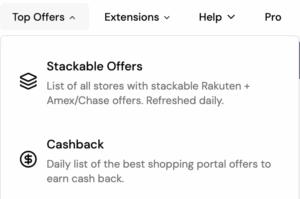

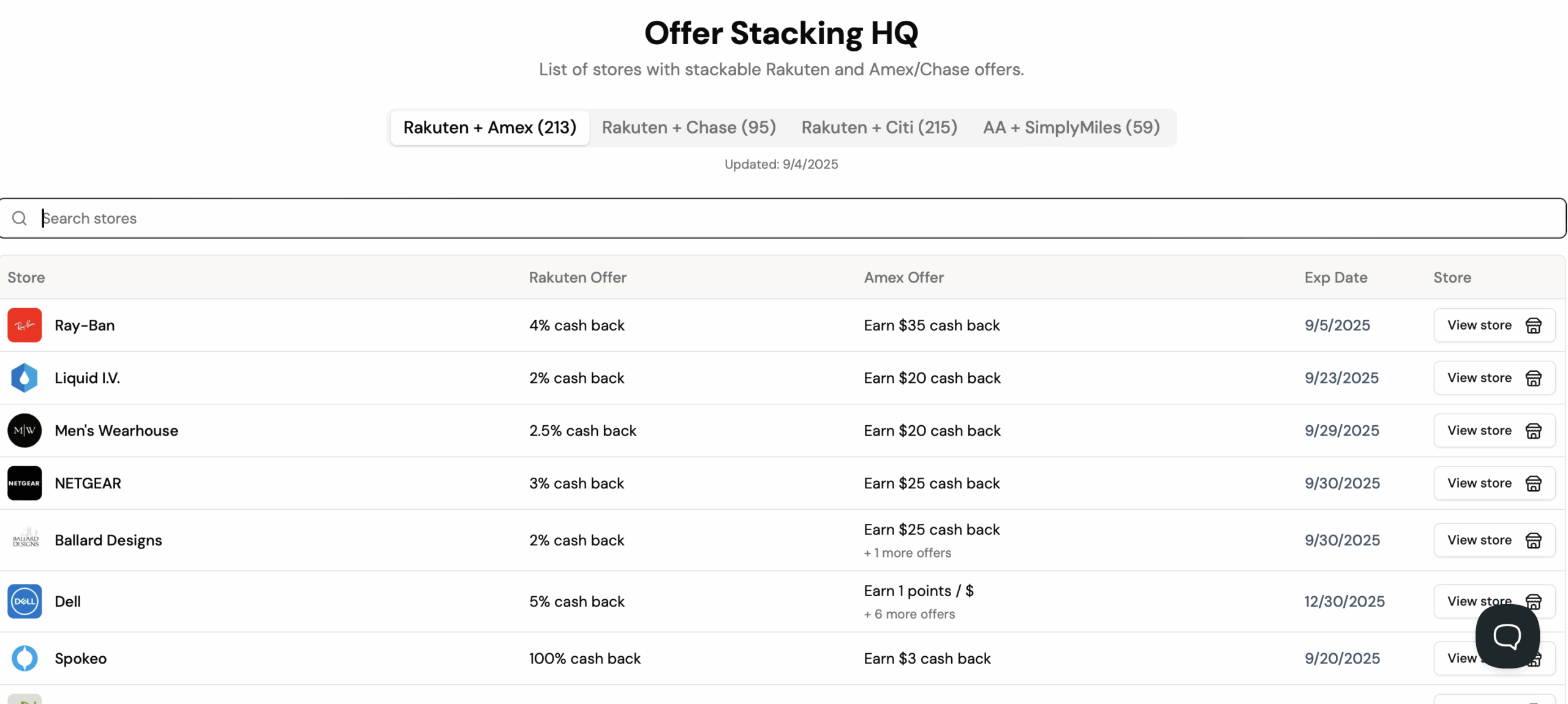

One of my favorite features is looking at all the stackable offers. I can find these by looking at “Top Offers” and scrolling down to the “Stackable Offers” section.

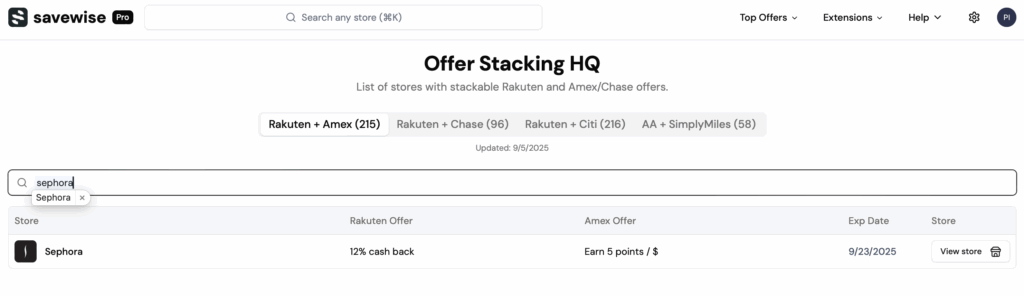

I can then put the store information in one spot and gather all the details. In the following instance, I put in Sephora, another store I like to shop at.

Easy, peasy! I can see that I can stack a great Rakuten offer with a great Amex offer to save even more when I put my Sephora order in today! You can sign up for Savewise here.

Bottom Line

If you frequently shop online 🙋🏻♀️ or want to squeeze every drop of value from your credit cards, Savewise gives you an easy way to make that happen. Instead of juggling separate tabs or remembering which portal offers the best rate, it can help you make smarter choices—fast. Free travel with Savewise may not provide the same value as a big welcome offer, but it is an easy way to earn extra points and miles consistently. Check out the Savewise tutorial for more info!

Related Posts

Podcast 82. Travel Nearly Free Forever: How to Earn Points and Miles for Years to Come

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.