October 1, 2025

Chase Freedom Flex℠ Quarter Four Bonus Categories

Alex

It is no surprise that we love Chase Ultimate Rewards®! We are always trying to earn more of them to book great Hyatt stays. A favorite credit card that allows us to earn Ultimate Rewards® is the Chase Freedom Flex℠. We love the Freedom Flex because of the quarterly spending bonus in rotating categories. Maximizing these bonus categories each quarter can earn you up to 30,000 points every year! You can read our review of this card here.

All information about the Chase Freedom Flex℠ has been collected independently by Travel Mom Squad. The Chase Freedom Flex℠ is no longer available through Travel Mom Squad.

Spending-Category Bonuses

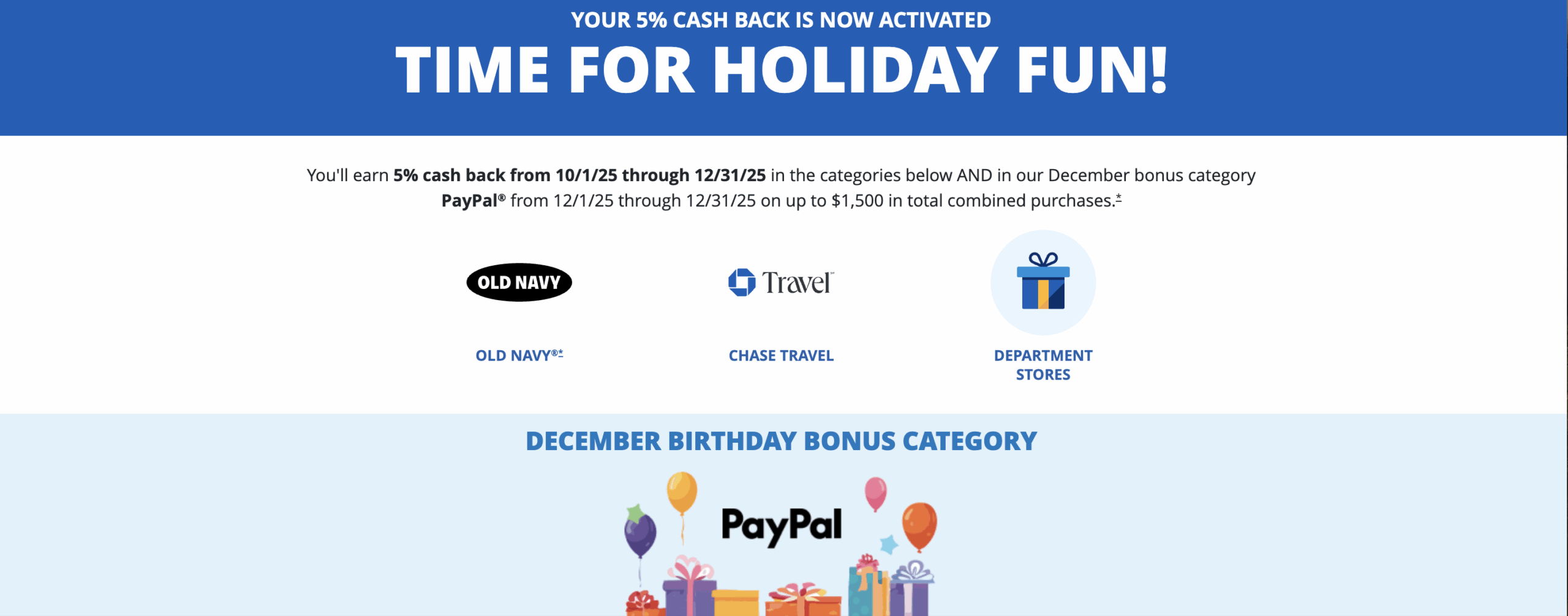

Cardholders can earn 5% cash back (5 Ultimate Rewards® points per dollar spent) on up to $1,500 in combined spending in categories that change every quarter when cardholders activate the bonus. Remember, you must activate the bonus every quarter! Go here to do that. Eligible cardholders can activate their next quarterly spending bonus online or in the Chase app until 12/14/2025.

The Chase Freedom Flex℠ quarterly spending bonus categories for the fourth quarter (Q4), starting October 1, 2025, are:

- Old Navy®

- Chase Travel℠

- Department stores

- Plus a special December bonus category: PayPal®

Two Things to Note in Q4

First, in addition to the three bonus categories that earn extra points all throughout the fourth quarter (October through December), Chase is adding PayPal® as another bonus category, but only in the month of December. So if you are eyeing any specific PayPal® purchases in order to maximize your bonus earnings, be sure to make those purchases in December to earn the most points.

Second, the extra 4% cash back quarterly bonus earnings on Chase Travel℠ purchases in Q4 is stackable with the normal 5% cash back you earn for all Chase Travel℠ purchases when you use your Chase Freedom Flex℠, for a total of 9% cash back (4% quarterly bonus + 5% everyday Chase Travel℠ bonus). Here’s what the bank says: [T]his quarter, you earn more on bonus categories by stacking with your standard category earn. For purchases made through Chase Travel, you will earn 9% cash back (5% Chase Travel cash back + 4% bonus category cash back.) Because they don’t count the 1% you earn from everyday non-bonused spending on the card twice, it adds up to 9%, not 10%. But 9% is still pretty great!

How “Cash Back” Becomes Ultimate Rewards®

If you don’t have card_name, card_name, card_name, or Ink Business Preferred® Credit Card, this card is just a cash-back card. But if you have one of those cards, you can transfer your points from your Chase Freedom Flex℠ account to one of those cards’ accounts, and voilà, they become Ultimate Rewards®!

All information about the Ink Business Preferred® Credit Card has been collected independently by Travel Mom Squad. The Ink Business Preferred® Credit Card is no longer available through Travel Mom Squad.

Bottom Line

The Chase Freedom Flex℠ is one of our favorite cards. The quarterly spending categories on this card are a great way to help us earn more Ultimate Rewards®.

Related Posts

Chase Freedom Flex℠ Card Review

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.