June 23, 2025

The Ultimate Credit Card Offer Drop: What’s New + What to Apply For

Jess

Today will likely go down in history in the points-and-miles world! Three new offers + one brand new card just dropped. 🤯 In this post, we’ll break down all of the offers, compare them, give our takes, then share each of our strategies for these offers! By the end, you’ll have a better idea of which ones to apply for and which ones to skip.

Overall Changes to Keep in Mind as You Review These Offers

- You can now hold both the card_name and the card_name, and you may be eligible to earn the welcome offers on both.

- UPDATE: Most people who currently hold a Chase Sapphire Preferred® card are being denied for the Chase Sapphire Reserve®.

- Chase is moving towards a pop-up model (similar to American Express) when it comes to eligibility. When you click “submit” on an application, Chase will do an internal check to see if you are eligible for the welcome offer before a soft or hard pull takes place. You can then decide whether you want to move forward based on the message you receive.

- Points Boost will be replacing the current 1.25 cents/point value (for the Chase Sapphire Preferred® Card) and 1.5 cents/point value (for the Chase Sapphire Reserve®) when redeeming points through Chase Travel℠.

- The Chase Sapphire Preferred® Card will now offer a variable 1.0-1.75 cents/point value when redeemed through Chase Travel℠.

- The Chase Sapphire Reserve® will now offer a variable 1.0-2.0 cents/point value when redeemed through Chase Travel℠.

card_name

Learn How to Apply

bonus_miles_full

This is the one we’re most excited about! It’s a brand new card, and because it’s a business card, it won’t count towards 5/24. You might see the $795 annual fee and freak out . . . and we don’t blame you! It does come with a lot of perks that offset that fee, though. The minimum spend is also quite high and won’t make sense for everyone (but note that you do have six months to meet it which is twice the amount of time given for similar premium cards with high minimum-spending requirements).

The welcome offer on this card makes the fee absolutely worth it for the first year for us. After that, we’ll decide whether we want to keep, downgrade, or close the card.

Think you don’t qualify for a business card? Think again! In that post, we cover exactly how easy it is (and there’s even a video application walkthrough at the end)!

Our Take:

- Who it’s for—

- Business owners who can meet the minimum spend (even if you don’t have a ton of revenue or employees)

- Those under 5/24

- Those who want complimentary access to Chase Sapphire Lounges and Priority Pass lounges (+ 2 free guests!)

- Those who want to take advantage of a brand new card + incredible welcome offer!

- Who it’s not for—

- Those at or over 5/24

- Those who cannot justify a $795 annual fee/cannot offset the fee with the credits and perks

- Those who cannot spend $30,000 in six months

card_name

Learn How to Apply

bonus_miles_full

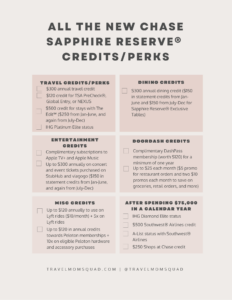

This card was just revamped! Yes, the annual fee increased from $550 to $795. But Chase also added a slew of new credits and benefits (including a $500 credit that you can redeem for a one-time purchase in the Chase Travel℠ portal). As busy moms, we understand that redeeming credits can be annoying and time-consuming, so this offer may not be appealing to everyone. But combined with the elevated welcome offer, it could make sense at least for the first year. Unlike the business version, the personal card will count towards 5/24.

Unfortunately, Chase is moving towards a pop-up model (similar to American Express) when it comes to eligibility for card_name. That means if you’ve previously earned the welcome offer, you may not be eligible to receive another one (even if it’s been more than 48 months). You can also apply for both the personal and business versions, though we advise waiting at least 30 days between applications.

The offer details state, “This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility.”

Our Take:

- Who it’s for—

- Those who are ok adding to their 5/24 count

- Those who want complimentary access to Chase Sapphire Lounges and Priority Pass lounges (+ 2 free guests!)

- Those who want to take advantage of a refreshed card + elevated welcome offer!

- Who it’s not for—

- Those at or over 5/24

- Those who cannot justify a $795 annual fee/cannot offset the fee with the credits and perks

card_name

Learn How to Apply

bonus_miles_full

The #1 card we recommend is also back with a new offer! If you’re looking for a card with a much lower annual fee, this could be the offer for you. This is a personal card and will count towards 5/24.

Unfortunately, Chase is moving towards a pop-up model (similar to American Express) when it comes to eligibility for card_name. That means if you’ve previously earned the welcome offer, you may not be eligible to receive another one (even if it’s been more than 48 months).

The offer details state, “This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility.”

Our Take:

- Who it’s for—

- Those under 5/24

- Those who prefer a lower annual fee

- Who it’s not for—

- Those at or over 5/24

- Those who want complimentary access to Chase Sapphire Lounges and Priority Pass lounges

card_name

Learn How to Apply

bonus_miles_full

While this card doesn’t earn the flexible points and miles we love, it’s a great offer for anyone who has had their eye on United miles or lives in a United hub. Ted has had this card since it first launched, and it’s been a keeper for us thanks to the United travel credits, free checked bags, priority boarding, and increased award availability/discounts for cardholders.

This is a personal card and will count towards 5/24.

- Who it’s for—

- Those under 5/24

- Those who are loyal to United/live in a United hub

- Those who have a plan for a stash of United miles

- Who it’s not for—

- Those at or over 5/24

- Those who do not want to be stuck with United miles (that can only be redeemed for flights through United)

Team Travel Mom Squad’s Plan

- Alex

- Alex is 4/24, so she’ll be applying for the card_name.

- Pam

- Jess

- Jess falls under 5/24 on July 1, so she’ll be applying for the card_name then.

- UPDATE: Jess was automatically approved for the card_name. She didn’t wait til July 1 as her fifth card was opened on June 3, 2023. Because it had been more than 24 months, she decided to try applying on June 24, and it worked!

- She has previously earned the welcome offers on both the card_name and the card_name, so she may not be eligible to earn them again, but she’s going to try! She will wait at least 30 days between applications, but isn’t sure yet which personal card option she’ll go for between the Preferred and Reserve.

- Jess falls under 5/24 on July 1, so she’ll be applying for the card_name then.

- Megan

- The minimum spend on the New Sapphire Reserve for Business card is a stretch, so she’ll be applying for the card_name.

- UPDATE: Megan applied for the card_name and it went pending. Later that day, she received an approval email! She also received a letter in her Chase account showing that Chase manually shifted her credit around to approve her (without her having to call reconsideration). Let’s hope this is the start of the new normal!

- The minimum spend on the New Sapphire Reserve for Business card is a stretch, so she’ll be applying for the card_name.

- Traci

- Traci is 3/24, so she’ll be applying for the card_name and adding her Player Two as an authorized user so they have two cards available to use for purchases, which will help them meet the minimum spend more easily.

- UPDATE: Traci was automatically approved for the card_name.

- She has a card_name right now, and it’s been 49 months since she earned the bonus points from the welcome offer, so Traci is going to wait and gather data points about how likely approval is if she were to downgrade this card and then reapply.

- Traci is 3/24, so she’ll be applying for the card_name and adding her Player Two as an authorized user so they have two cards available to use for purchases, which will help them meet the minimum spend more easily.

Related Posts

How to Qualify for a Business Credit Card

Chase 5/24 Rule Plus 10 Other Things to Know

Should I Cancel My Credit Card?

It Can Be Worth it to Pay an Annual Fee

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Thanks for all the new info, exciting times! Also, loved the plans each of you have, thanks for sharing your personal thoughts!

I got the Chase Sapphire Preferred earlier this year with the bonus. It sounds like you may not be approved for this card if you have received another bonus from a Chase card? Is it still worth applying?

You may still get the Sapphire Reserve® – it’s worth trying!

I also got the Chase Sapphire Preferred card within the last year. I just tried to apply for the reserve and got the pop up that said I wasn’t eligible for the bonus on the Reserve; but it let me cancel before the hard pull on my credit. So it’s worth a shot!

I received the pop up as well saying I was ineligible because I recently opened the Chase Sapphire Preferred.

This is so much great intel. I must really absorb it to make a choice and decision. My family and I have decided that we’re going to spend the next few years (at least) focused on USA and Caribbean travel. Any insights or opinions folks have based on that focus would be great!

Check out all of our trip reports and reader success stories about US and Caribbean travel!