October 17, 2024

Two Fun Credit Card Benefits

Pam

I just learned about two fun credit card benefits that I haven’t taken advantage of and both include the ability for free treats monthly for me! Now you know that I am all about that! Let’s go over them today.

DoorDash $10 Monthly Credit

I just learned about a great benefit for my card_name: $10/month in free grocery items! Amid all my travel, I missed the announcement that DoorDash and Chase had partnered to offer grocery benefits. Additionally, just for holding the card, I can get a free DoorDash membership through December 31, 2027.

I did have to do a few things to take advantage of this benefit:

- I downloaded the DoorDash app to my phone.

- I linked my card_name as a payment method. card_name and card_name will give you TWO $10/month credits.

- Activated my DoorDash Pass to get the free credits.

Suggestions on Using the Credit

You can do a pickup to save on delivery charges. This is my preference. I like to pick up $10 worth of items at my local 7-11 (treats, usually😜). I could also pick up a pizza there, and I may try that next time.

First, I searched for grocery items near me and found the following stores:

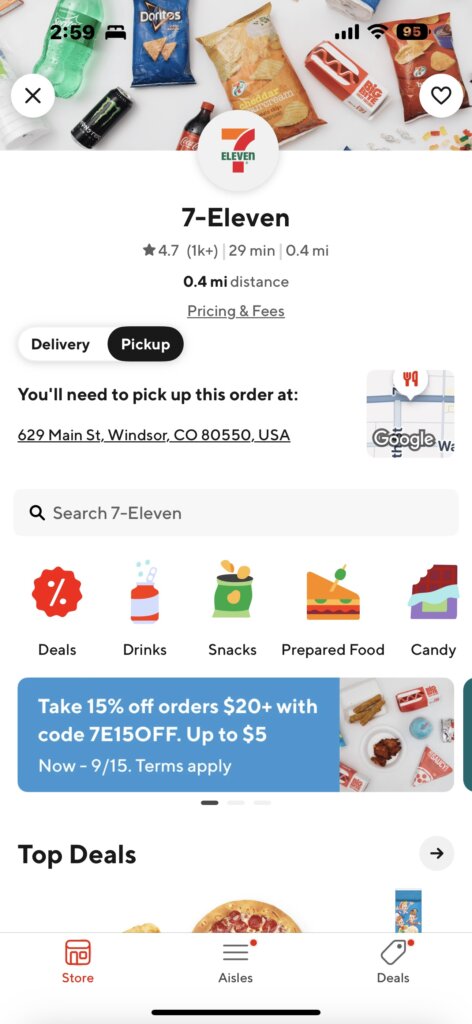

Next, I chose my local 7-11 and chose pickup.

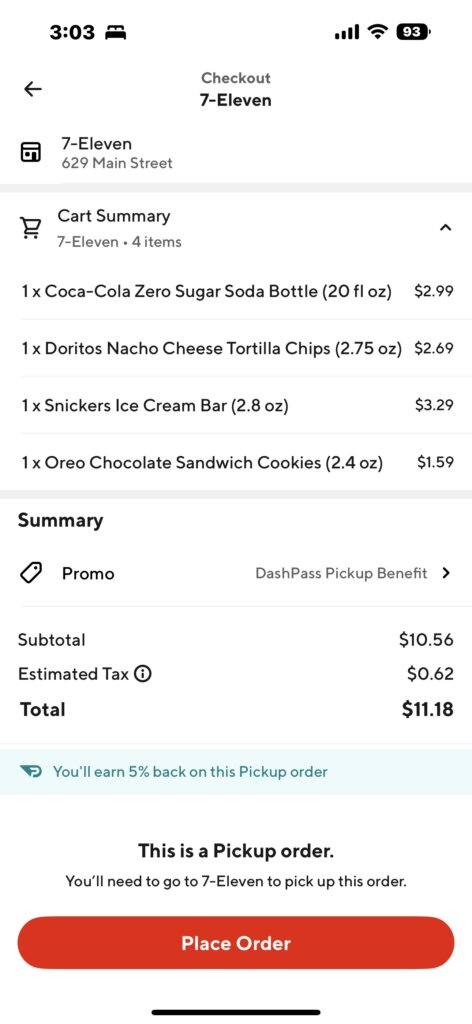

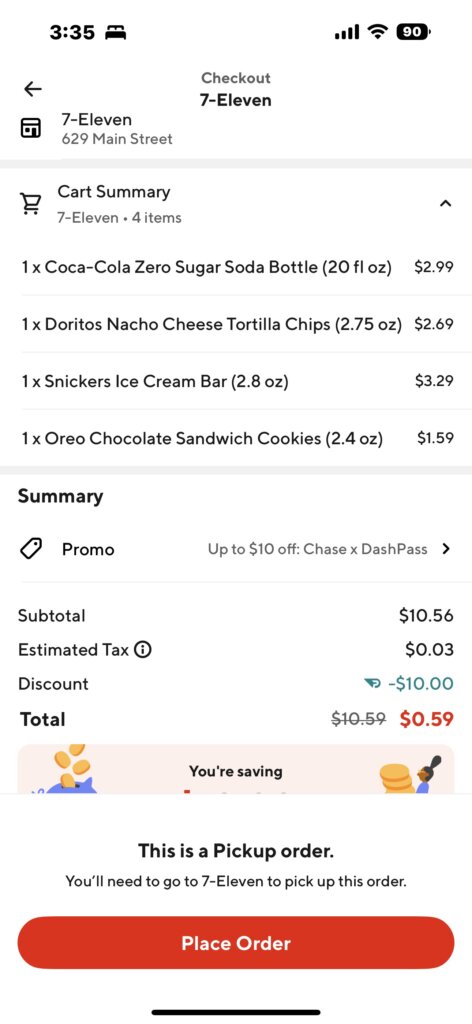

Then, I chose some not-so-healthy treats. The total was over $10, so I will be charged $1.18 on my card.

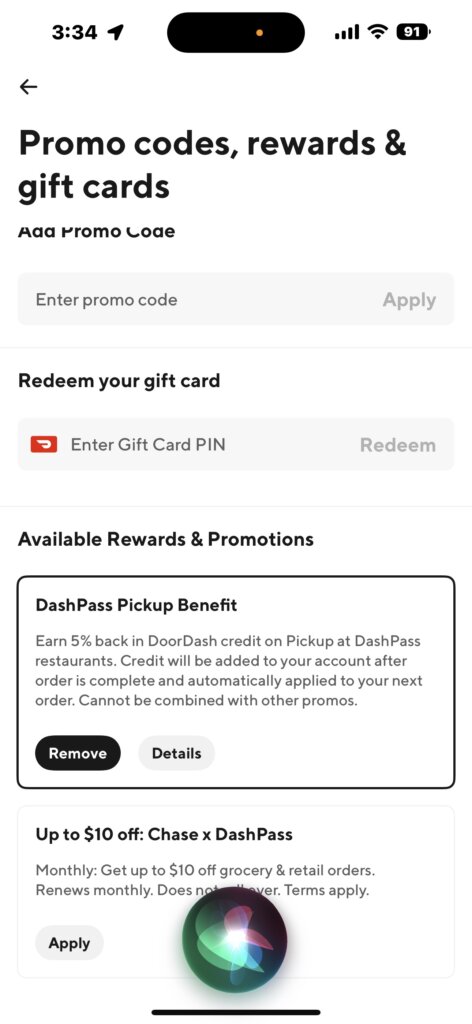

Be sure and apply the promo code before you place your order – this is your most important step! The first time, I forgot to do it and paid for my treats 🤦♀️.

In this screenshot, you can see that it has been applied. Here is the last screenshot taken just before I placed the order. Note that the taxes have been reduced, and I actually owe $0.59.

Lastly, I go to my 7-Eleven and pick up the order. Voila! $10 of treats a month are all mine! It was super easy to do and they had my treats ready in a little bag. I just showed the confirmation message on the app.

Recently, I downgraded my card_name and got the card_name which gave me $10 (twice) for treats at my local 7-11. I just do separate orders and pick them up at the same time.

Dunkin Donuts $7 Monthly Credit

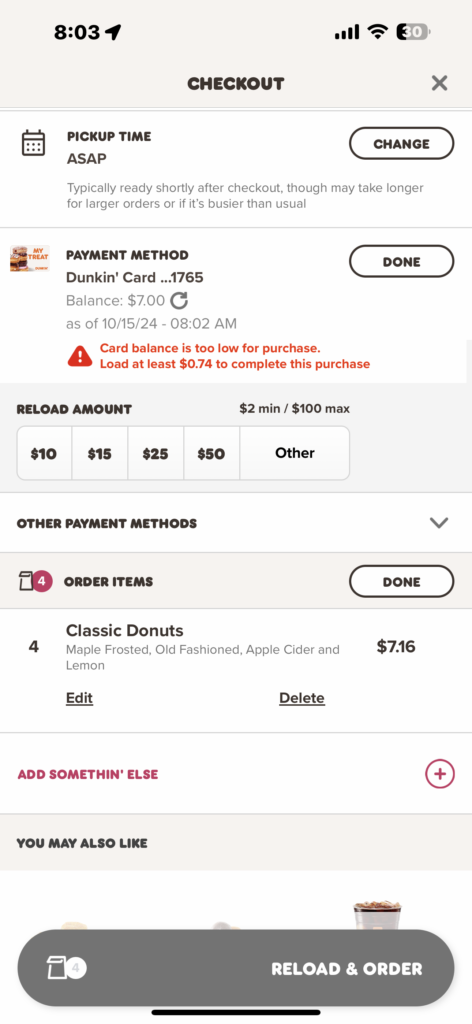

I can also use a $7 monthly credit at Dunkin Donuts because I have the American Express® Gold Card. Enrollment is required.

Again, I have to do a few things:

- Download the Dunkin Donuts app on my phone.

- Join Dunkin Rewards on the app.

- Add a Dunkin’ Card and Pay In-App

- Add my Gold Card as the payment under scan/pay on the app.

- Load $7 onto my gift card monthly. I like doing it this way so that my $7 amounts add up until I want to use them.

- Use that gift card to pay for my purchase through scan/pay on the bottom of your screen.

- Note: If your purchase is more than $7, you will also have to add that amount to your card unless you’ve added multiple credits to your card.

- Many readers say that you can just pay with your Gold card and you get the credit without using the Dunkin’ Card gift card.

This credit also has a bonus—it can be used at Baskin Robbins! I would prefer to use this credit this way!

$7/month in free ice cream? Yes, please!

Bottom Line

These are easy credits for me to use on two credit cards I already have. These two fun credit card benefits are something I can use as a fun treat for a grandchild, too! Are you using your credits?

Related Posts

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Seems as though none of my grocery offers pickup. Boo hoo

Neither does mine, so it looks like I’m limited to 7-11s (but you can use the credit for alcohol).