November 29, 2022

Ultimate Guide to Combining Points/Miles

Pam

You’ve earned those points/miles and want to combine them with a spouse/partner/friend – how do you do that? Unfortunately, each program has its own rules and regulations for this, so it can be confusing. Here’s our ultimate guide to combining points/miles you’ve earned with another person.

Chase Ultimate® Rewards

We have a whole post about this that will help you, but basically, the first time you want to combine points, you have to call Chase and have them link the accounts. Once this is done, you can then combine points on your own through the Chase site. You are only allowed to combine points with people in your household.

The ability to combine Ultimate Rewards might make your Hyatt stay a reality.

Capital One Venture Rewards

Capital One Venture Rewards can be transferred to anyone with a Capital One Venture card. They don’t have to be a spouse. You do need to call them on the number on the back of your card to initiate this. There isn’t a way to do this in your online account. You will need the name and card number of the person you want to transfer to when you make the call.

American Express Membership Rewards

Sadly, you cannot combine your Membership Rewards with anyone else, even a spouse. Your rewards, even those earned on different AMEX cards, will all combine automatically into your own account but cannot be combined with another person. To get around this, just book a flight or hotel for someone else with your points. For instance, sometimes my husband and I book flights for both of us with his rewards, and sometimes we use my rewards.

There is one exception and that is that you can transfer points to the loyalty program of an authorized user’s account. Years ago, I made myself an authorized user on one of my husband’s cards so I can combine points with him. You have to have been an authorized user on one a card for at least 90 days, though. Not sure if that is worth taking a 5/24 spot but it does work.

I often use my AMEX rewards to book a flight for myself and my husband.

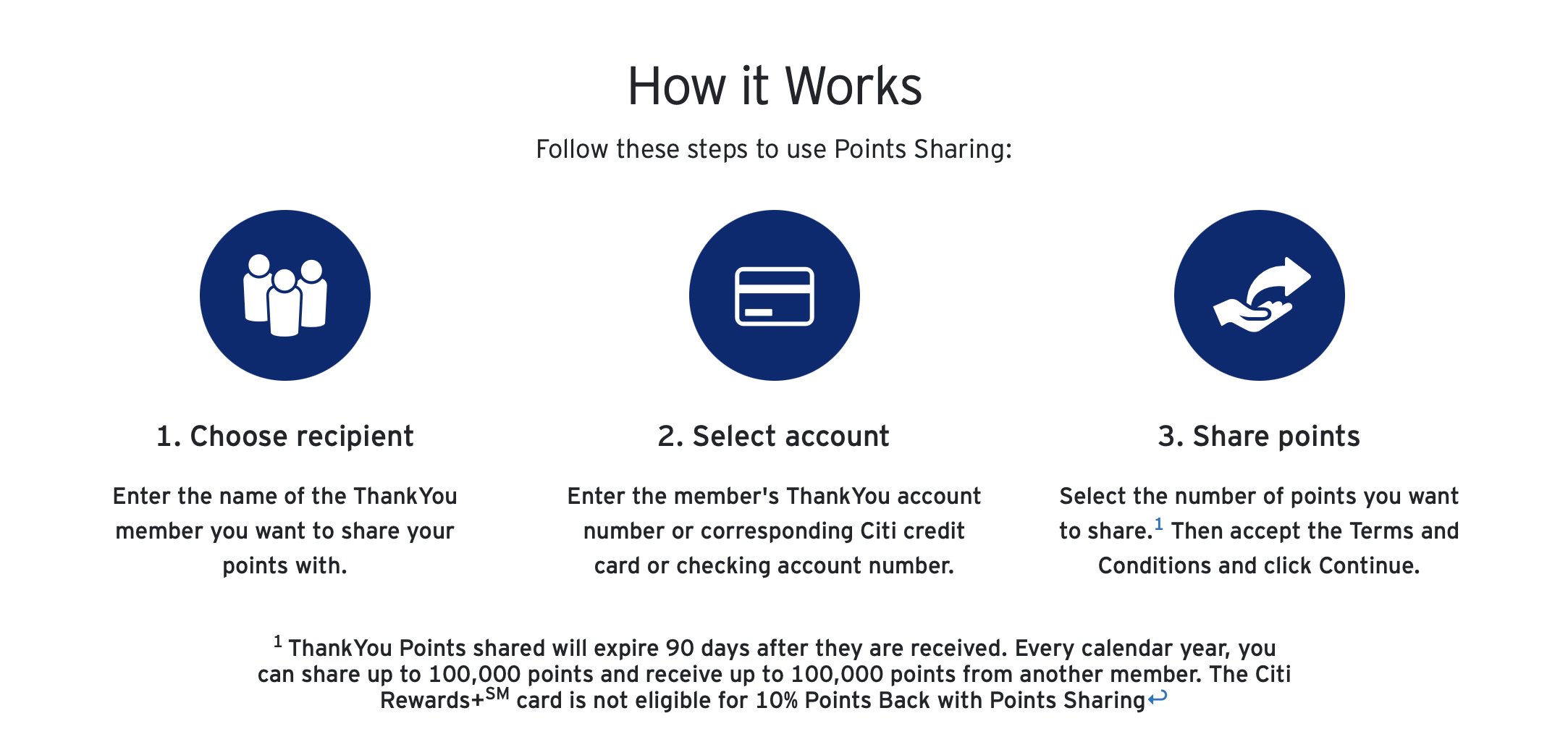

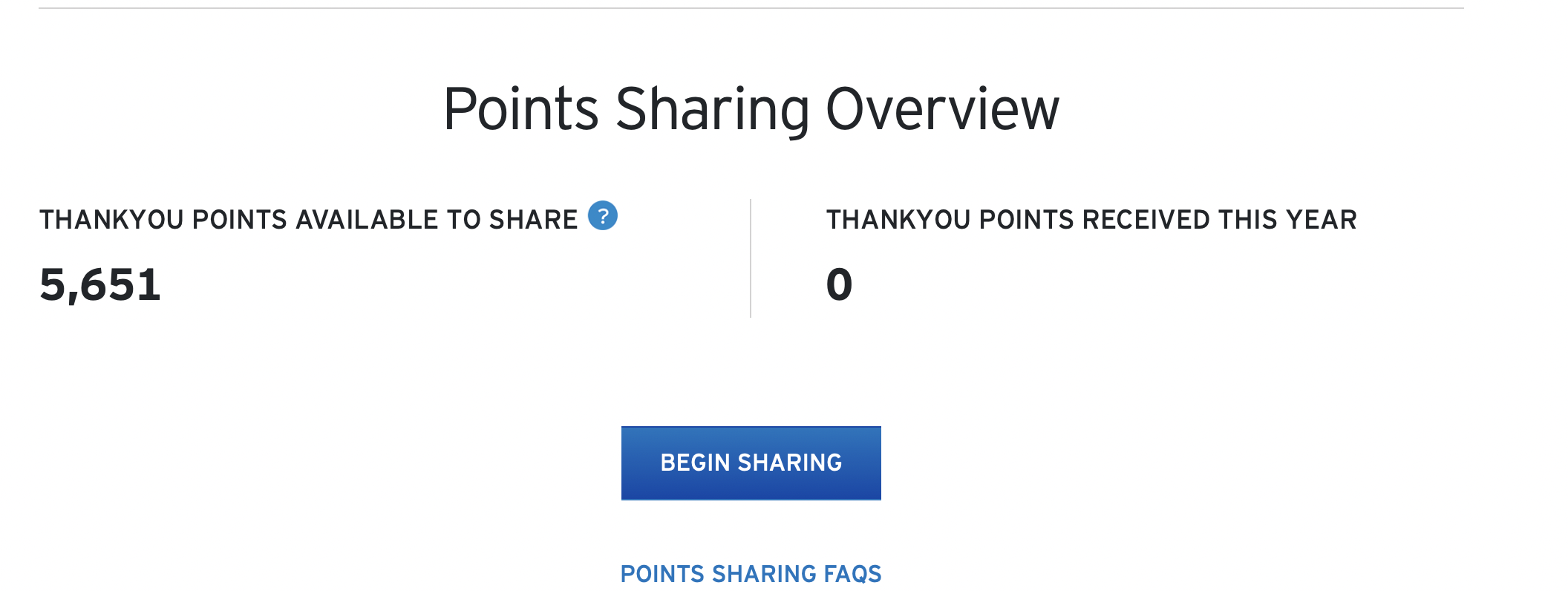

Citi Premier ThankYou Points

You can share up to 100,000 Citi ThankYou Points a year (total) with another person with a Citi card that earns ThankYou Points. Shared points expire 90 days after being received, so only do this when you are planning to book a trip. Once you get into the Citi ThankYou points section, hit “more ways to redeem” and then choose “points sharing.”

World of Hyatt Points

World of Hyatt members are eligible to combine points. Members may only transfer or receive points once every 30 days. You have to fill out an online form to do this. It may take some time for the transfer to complete, so keep this in mind.

Marriott Bonvoy Points

You can transfer 100,000 points/year to another person by calling Marriott by phone. You will need to have the information regarding the other person’s account number to do this.

I recently spent Marriott Bonvoy points at the Wailea Beach Club, and combining points with my spouse made it possible!

IHG Points

Using this link, you can transfer points for $5.00 per 1,000 points. This only makes sense if someone needs just a few thousand points to book a stay. However, if you have a small business (and everyone in the points and miles hobby should have a business), you can sign up for a free IHG Business Rewards account. Readers have reported transferring points for free once they’ve enrolled in this program, using this link. You can also transfer points for free if you have IHG Diamond Status.

Hilton Honors Points

You can “pool your points” with up to 10 other members. You can send up to 500,000 points and receive up to 2 million points per calendar year for free.

By combining points with my spouse, I could book this Hilton in Tahiti.

Airline Miles

Unfortunately, only four of the major U.S. airline allow you to combine miles.

- JetBlue allows family and friends to pool their miles together. Once pooled together, one person assumes the role of manager.

- Frontier allows the pooling of points for up to 8 people, but the head member in the pool has either Frontier Airlines elite status or the Frontier Airlines World Mastercard.

- Hawaiian Airlines lets HawaiianMiles members share their miles with a Hawaiian Airlines primary credit or debit cardholder free of charge.

- United Airlines allows point pooling for up to five family and friends.

Bottom Line

Combining points/miles with family and friends helps us book travel more easily. Hopefully, this guide will be a great reference for you in knowing how to do this!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.