January 3, 2019

5 Reasons Why I Love The World of Hyatt Credit Card

Alex

The World Of Hyatt Credit Card is one of my favorites! Between the welcome offer and the five reasons below, I think it is a card worth having.

All information about the World of Hyatt Credit Card has been collected independently by Travel Mom Squad. The World of Hyatt Credit Card is no longer available through Travel Mom Squad.

Those points can be used for stays at the all-inclusive Hyatt Ziva Los Cabos (good for 2 guests), the Grand Hyatt Kauai, the Hyatt Regency Paris Étoile, the Park Hyatt Maldives (pictured above…but for reals how amazing does that look?!), or many other destinations! Here are five reasons that I have The World Of Hyatt Credit Card and why I think you might want to consider it.

There is also a card_name so that we can earn even more Hyatt points! It comes with a $199 annual fee, but you will get a $50 statement credit twice per card member year on Hyatt purchases, which brings the yearly fee to $99.

Reasons We Love Hyatt Credit Cards

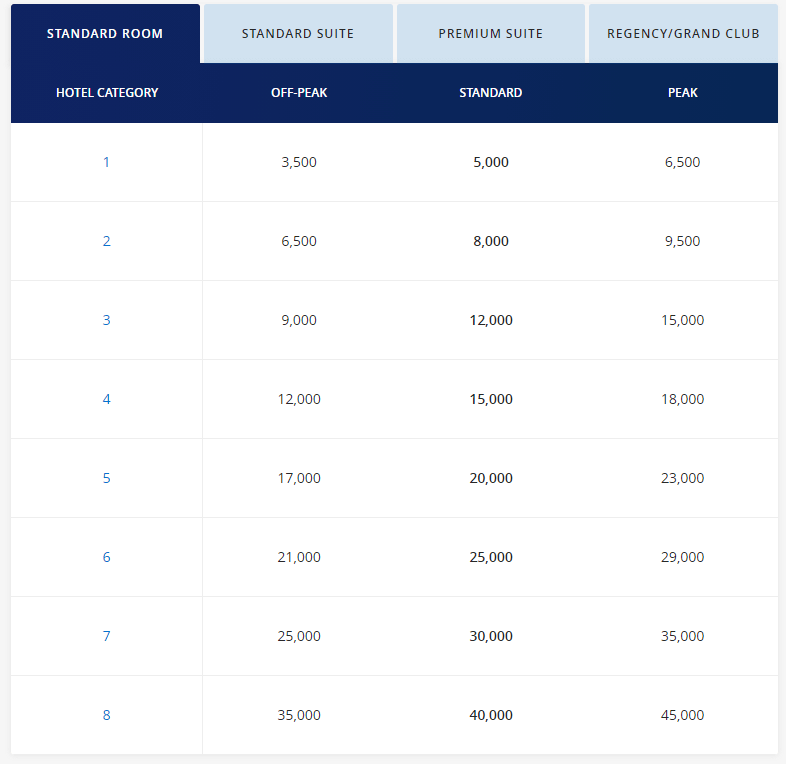

1. Lower Award Chart Rates

Hyatt scores major points in my book for their very reasonable award chart. Free nights start at 3,500 points a night on the lowest end (category 1) and 45,000 points a night on the highest end (category 8). The majority of their hotels are 25,000 points a night and below.

2. Hyatt is a Chase Transfer Partner

Hyatt is one of the many Chase transfer partners. This means that you can use the points you earn from one of your Ultimate Reward-earning cards, like the Chase Sapphire Preferred® Card, to transfer them into your World of Hyatt account. Chase is also a transfer partner with Marriott and IHG. With all of these hotel chains, your Chase Ultimate Rewards® transfer at a 1:1 ratio. Due to Hyatt’s lower award chart rates, your points will go much further when you transfer them there.

To transfer your points, you must have a card_name, card_name, Ink Business Preferred® Credit Card, or a card_name. Transferring points is super simple, and you can do it by logging into your Chase account. I love being able to top off my Hyatt account with some Ultimate Rewards to get me a couple of extra nights somewhere. That is precisely what we did when we went to Kauai and stayed at the Grand Hyatt. If you have one of the Ultimate Rewards earning cards and want some free hotel nights, then a World of Hyatt Card is perfect for you!

All information about the Ink Business Preferred® Credit Card has been collected independently by Travel Mom Squad. The Ink Business Preferred® Credit Card is no longer available through Travel Mom Squad.

3. Free Hyatt Hotel Award Night Each Anniversary Year

Each year after your cardmember anniversary, you will receive a free night certificate at a Hyatt category 1-4 hotel. I find this free night to be worth paying the annual fee, especially if I can use it during peak times when hotel cash prices are higher. In addition to this anniversary free night award certificate, you can earn another by spending $15,000 a year on your World Of Hyatt Credit Card. The Brand Explorer Award (aka Hyatt Bingo) also lets you earn another free night.

Examples of Where You Could Use Your Free Night:

Hyatt Place Park City

Andaz Savannah

And more Hyatt Hotels! Like…..

Hyatt Vacation Club at Piñon Pointe, Hyatt House at Anaheim Resort/Convention Center, Hyatt Regency Lisbon, and many more!!

These category 4 hotels run 12,000-18,000 points per night. I love using my anniversary-free night from my World of Hyatt Card and transferring some Ultimate Rewards into my Hyatt account for a long weekend trip!

4. No Resort Fees on Hyatt Award Bookings

You don’t have to pay resort fees when you book your Hyatt hotel using points. It is actually free!! Our stay at the Marriott Wailea Beach Resort cost us over $200 in resort fees. Still, it’s a great deal to get five nights there and only pay resort fees, but it’s not free like Hyatt!

5. Great Family Hotel Options

Another reason I love Hyatt is that their Hyatt Place and Hyatt House hotels are great options for families. They sleep more people, include complimentary breakfast, and usually don’t cost too many points. I love staying in places like this when we aren’t going to spend too much time at the hotel or just need a place for a night or two.

Bottom Line

There are so many great Hyatt options all over the world! I love the generous award chart and the fact that I can use my Chase Ultimate Reward points to book rooms. The World Of Hyatt Credit Card is one I always plan on keeping!

Related Posts

Best Hyatt Hotels to Use a Free Night Certificate

Hotel Credit Cards Worth Keeping

Podcast 54. The Golden Key to Travel: Hyatt Globalist Status Unveiled

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.