December 19, 2024

How I Got Approved for the Capital One Spark Cash Plus

Jess

The card_name came out with an elevated welcome offer back in August, and I’ve been on a mission to snag this card ever since. It’s marketed as a cash-back card, but if you have another card that earns Venture miles (like the card_name or card_name), you can convert the cash back you earn from the Capital One Spark Cash Plus into Capital One Venture miles. This business card also doesn’t count towards 5/24. Because approval for this card can be a little tricky, I’m sharing how I got approved for the Capital One Spark Cash Plus.

Learn How to Apply

bonus_miles_full

The standard welcome offer is $1,200 cash back, which you can convert to 120K Capital One Venture miles. But since August it’s been $2,000 cash back, which you can convert to a whopping 200K Capital One Venture miles!

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Minimum Spend 🤪

Before I get too far into the details of how I finally got approved, you should know that the minimum spend on this card is quite high. You’ll have to spend $30,000 in the first 3 months to earn the $2,000/200,000-mile welcome offer. That averages out to about $10,000/month. Yikes!

I planned to open this card towards the end of 2024 because I know that I have some significant expenses in December and the beginning of January 2025 (mostly estimated taxes) that make this welcome offer doable. Maybe you’re in a similar position this time of year!

The Spark Cash Plus is also a charge card, which means you will not have a set credit limit and will have to pay your balance in full every month.

Third Time’s the Charm!

Here’s how I finally got approved for this card on the third attempt:

-

- 9/9/24—First application: immediate denial. Reason was “too many accounts of this type.” WHOOPS! Forgot that you won’t be approved for the Spark Cash Plus if you currently have the card_name. I had actually been intending to close my Venture X business card because it had been exactly a year since I opened it (and I don’t need both the personal Venture X card and the Venture X business card). My exact open date for the Venture X business card was 9/12/23.

-

- 9/14/24—I close my Venture X business card (you can actually do this online via your Capital One portal).

-

- 10/15/24—Second application: immediate denial. Reason: “Based on your credit report from one or more of the agencies on the back of this letter, there have been too many recent inquiries.” The agency listed on the letter was Experian. All of my recent Chase inquiries were showing up on my Experian credit report. I do some additional research and decide to freeze my Experian credit report. (Note that you will want to freeze the credit report with the most inquiries on it—this may or may not be Experian for you.)

-

- 11/2/24—I freeze my Experian report. The following day I receive an email confirming that it’s frozen.

-

- 11/16/24—Third application: immediate approval!

Converting Cash Back to Venture Miles

Because the card_name earns 2% cash back on every purchase, after meeting the $30,000 minimum spend, I will have earned $600 cash back from spend and $2,000 cash back from the welcome offer. If you have a Venture Miles-earning care, you can move that cash back to one of those cards, making it miles. That means, you’ll get a total of 260,000 Capital One miles from one welcome offer and just a $150 annual fee! I am planning to put these miles towards flights to Tanzania for an African safari for my 40th birthday in February 2026.

It will come in the form of cash back ($2,600), and I plan to convert that cash back to Venture miles via my Capital One online portal.

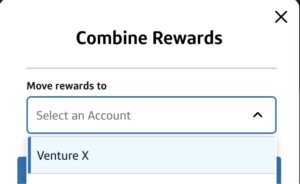

To convert cash-back into Venture miles, log into your Capital One online account and select “View Rewards.” Select your Spark Cash Plus account, then select “Combine rewards.” I’m choosing to move the miles to my personal Venture X card account.

From there, simply enter the amount of cash back you’d like to convert to miles, and select “Confirm.” That’s it! Your cash back has now become Capital One miles that can be transferred out to travel partners.

The transfer was instant—in just a matter of minutes I went from having $100 in cash back to 10,000 Capital One Venture miles added to my account.

Bottom Line

Persistence paid off! I did make some mistakes along the way, but in the end, I got the approval I wanted. (Had I remembered to close my Venture X Business card first, I could have saved myself an application.) But I’m so excited for these miles and can’t wait to put them towards even more nearly free travel!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

How did you freeze your experience man account? Was it with a phone call, or can you do it online?

Online on the Experian website.

Thank you for this! I didn’t realize you could re-apply for cards so soon and that freezing a credit report would make a difference. This worked for me.

Did you wait for the letter in the mail each time to find out the denial reason or was it stated on the screen at the time of denial? I was just denied with only a Venture X and Experian frozen, so not sure what to do to try and fix it.

I waited 3 weeks and reapplied, this time freezing my TransUnion account and it worked!

I have a business with an EIN and a business with my SSN. Do you think I can get the capital one spark for both business seeing as they are different or will they reject me because they’re both under my name? Would love your thoughts!

I think you can only get one. You can’t hold this and a Venture X Business so I believe they are strict about how many they approve. Not 100% sure but that is my thought.

Pam, this is so helpful, thanks! If my husband has the personal Venture X but I don’t, can I apply for this card and then transfer the points to his Venture X account so we can use them for travel?

Yes, you can!

I have the Venture and VX and a $30K spend due in May. My most recent card was 12/15/24 AMX Bsn Gold. I have thawed my credit. Should I check and see which bureau has most inquiries, and freeze that one, or just keep all thawed to apply?

I would keep them thawed while you apply.

Thanks for the informative post! I wan to get this card for 1099 quarterly taxes, but I’ve heard that large charges can get declined on C1 business cards if they exceed your “spending power”—meaning they do have some kind of limit, but you don’t know what it is. If I make a big tax bill my first charge, do you think I’d run into this problem?

Mine let’s me get pre-approved for a spend so I always do that to see what they will approve me for.

If i already have a sparks cash plus card, can i apply for the venture x business since one is a cash card and one a miles?

No, you can only have one or the other at a time. We had the Venture X Business cards first and later, cancelled that and got the Sparks Cash Plus Card. You can do it the other way around if you’ve had it long enough.

I’ve started my application for the Capital One Spark Cash Plus and I came across this question. Is your business legally formed, incorporated and/or registered in the U.S.? I’m applying as a sole proprietor so technically the answer should be no, but that won’t let me complete my application. As a sole prop did you just select Yes?

They just want to know it was formed in the U.S. so yes.

I just applied for Venture with all 3 credit bureaus thawed and was denied. After reading this, I am realizing I should have kept Experian frozen (by far has the most inquiries). Is there a suggested wait time before I try again with Experian frozen? Seems like you waited 30 days?

Honestly, there are no real published data points on this that we know of. We can only report what worked for us. Pam froze Experian and was denied – they checked through TransUnion for her so it is all a guess, sadly.