October 8, 2025

How I Stream for (Almost) Free: Six Services Covered by My Credit Cards

Jess

My family might be addicted to streaming services. Seriously, I think we have them all! So when credit card benefits include credits for streaming services, I know those are benefits I’ll be able to take advantage of! Here are six streaming services covered by my credit cards (that I would 100% pay for regardless).

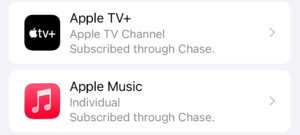

Apple TV+ and Apple Music

When the new benefits were announced for the refreshed Chase Sapphire Reserve®, I immediately noticed the Apple TV+ and Apple Music benefit. With the Chase Sapphire Reserve®, you’ll now get up to $250 in Apple TV+ and Apple Music subscriptions. Eligible subscriptions currently run through June 22, 2027, but I wouldn’t be surprised if that gets extended.

Apple TV+ costs $12.99/month, and Apple Music costs $10.99/month. These are both services I paid for before applying for the Chase Sapphire Reserve®, so I am taking full advantage of the $250/year benefit. You can easily activate these benefits under the “Card benefits” section of your Sapphire Reserve® online account.

I activated these benefits and never even get billed for them!

Disney+, ESPN, and Hulu

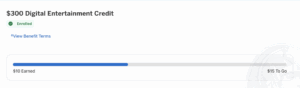

Disney+ is where the Eras Tour concert film lives, so you know it’s a necessity in our house. I could personally do without ESPN, but my husband can’t. And Hulu has lots of shows we enjoy. Luckily, the American Express Platinum Card® comes with a $300 digital entertainment credit each year. With this credit, you can get up to $25 in statement credits each month when you make eligible purchases directly with Disney+, a Disney+ bundle, ESPN+, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV.

There are several Disney+ bundle variations. We pay $29.99/month for Disney+, ESPN Unlimited, and Hulu. (We got our first 12 months at this discounted rate, so keep an eye out for something similar). I know, I know—$300/year in statement credits is $25/month. So while this one isn’t completely covered, I’ll gladly pay $4.99/month to have all three of these services.

There are also bundles that include HBO Max instead of ESPN.

We also pay for YouTube TV, so even if we didn’t take advantage of this bundle, we would have another use for this credit. I’m impressed with all of the services eligible for the digital entertainment credit, and think most people can take full advantage of this $300/year benefit. Before subscribing to any of these providers, make sure you enroll via your online American Express account (under “Rewards & Benefits”).

Remember to enroll so you receive your $25/month in statement credits!

Paramount+

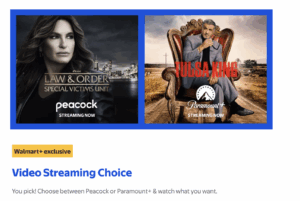

The American Express Platinum Card® also comes with a $155/year Walmart+ benefit—get up to a $12.95 statement credit back each month after you pay for a monthly Walmart+ membership. I know what you’re thinking—what does Walmart+ have to do with streaming services? I initially thought the same, as we don’t shop at Walmart.

But then I discovered that as a Walmart+ member, you get a complimentary subscription to either Paramount+ or Peacock! So I signed up for a monthly Walmart+ subscription, and after subscribing I was able to make my video streaming choice. We chose Paramount+ (a service that we were already paying for), and subscribing via Walmart+ was quick and easy.

Take your pick with Walmart+!

While Paramount+ and Peacock are also options for the $300/year digital entertainment credit, I would purposely not use the digital entertainment credit on whichever one of the two you choose. Instead, redeem the digital entertainment credit for a service that isn’t also included with Walmart+.

Bottom Line

Rising annual fees have me wanting to take full advantage of all of the benefits these premium cards have to offer. I was pleasantly surprised when I learned that several of the streaming services we were already paying for were covered by credits from these cards. Paying just $4.99/month out of pocket for six different streaming services is a win in my book! Have you taken advantage of these credits? If not, what are you waiting for?

Related Posts

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.