September 18, 2025

Review of American Express Platinum Card®

Pam

Today’s review concerns my favorite American Express credit card, the card_name which I plan to keep in my wallet. Despite an annual fee of annual_fees, I get more value from it than I pay. Skeptical? Stay tuned as I tell you why I love it so much….

For rates and fees of the American Express Platinum Card® , See Rates and Fees.

Learn How to Apply

bonus_miles_full

If you are interested in the American Express® Green Card or the card_name, you will want to apply for those before applying for the card_name. American Express now has a specific family language requiring you to get them in a certain order, or you will be locked out of the welcome offer.

Airport Lounge Access

Probably the number one reason I keep the card_name is that it provides me access to the best airport lounges. Although I love to travel, I’m not a fan of spending time at the airport, waiting to board, or passing the time during a connecting flight. Visiting a nice airport lounge and relaxing can make the experience more enjoyable.

I can find a comfy seat, watch a movie on my computer, find something to eat and drink, and use a clean bathroom. Occasionally, I’ve taken a shower on a connecting flight. This allows me to feel refreshed and ready to go sightseeing upon arrival at my destination.

Global Lounge Collection®

The card_name provides access to the best lounges, in my opinion, with their Global Lounge Collection®. These include:

- American Express® Centurion® lounges

- Priority Pass lounges

- 10 complimentary Delta Sky Club visits (when flying Delta)

- and other select partner lounges

With the card_name, I can literally find an airport lounge at almost any airport I travel to! And it would normally cost at least $50 to enter an airport lounge. My #1 reason for keeping this card is the ability to access all these amazing lounges.

Enrollment required for select benefits. Terms apply.

The Centurion® Lounge in Denver has welcomed me on multiple occasions before I boarded a flight.

$200 Airline Incidental Fee Credit

With this benefit, I select one qualifying airline to receive up to $200 back per year from for baggage fees and other incidentals. You can change this selection each year in January. Since I fly United frequently, I have selected it as my preferred airline. These incidentals include checked bags, in-flight refreshments, and lounge passes. I use my $200 credit for United TravelBank credits. You can learn more about how this works by checking out this post.

Enrollment required for select benefits. Terms apply.

$100 Saks Fifth Avenue or saks.com Credit

With the credit, you can get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on your card_name. That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. I usually use this credit to buy my more expensive creams or makeup.

Enrollment required for select benefits. Terms apply.

Up to $200 in Uber Cash + $120 Uber One Credit

If you use Uber regularly, these are great benefits! As a card_name, you can get up to $200 in Uber Cash annually ($15 per month plus an extra $20 in December) for rides and orders in the U.S. when you add the card to your Uber Account. Plus, when you purchase an auto-renewing Uber One Membership with the card_name, you can get up to $120 back in statement credits annually.

An Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit. Enrollment required for select benefits. Terms apply.

Enjoy a burger each month with your Uber Eats credit!

Fine Hotels + Resorts® or The Hotel Collection $600 Annual Credit

Get up to $300 in statement credits semi-annually (for up to a total of $600 in statement credits per calendar year) on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® using your card_name. I stayed at the Four Seasons in Sydney, Australia, using this credit, and received great value from it.

* The Hotel Collection requires a minimum two-night stay. Enrollment required for select benefits. Terms apply.

I stayed at this Four Seasons in Australia for almost nothing with my Fine Hotels and Resorts credit.

$300 Digital Entertainment Credit

You are also eligible to get up to $25 in statement credits each month when you use your card_name to subscribe to your choice of one or more of the following: Disney+, a Disney+ bundle, ESPN+, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV or make eligible purchases with these partners. I use mine for Hulu.

Enrollment required for select benefits. Terms apply.

Fee Credit for Global Entry or TSA PreCheck®

Receive either a statement credit every 4 years after you apply for Global Entry ($120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your card_name. When you enroll in Global Entry, you’ll also gain access to TSA PreCheck®, making it our preferred choice.

Enrollment required for select benefits. Terms apply.

$209 CLEAR® Plus Credit

Getting through the airport quickly is a priority for me, so I always use this credit. Use the Platinum Card® and get up to $209 back per calendar year on your CLEAR® Plus Membership (subject to auto-renewal).

Enrollment required for select benefits. Terms apply.

CLEAR gets me through the airport quicker!

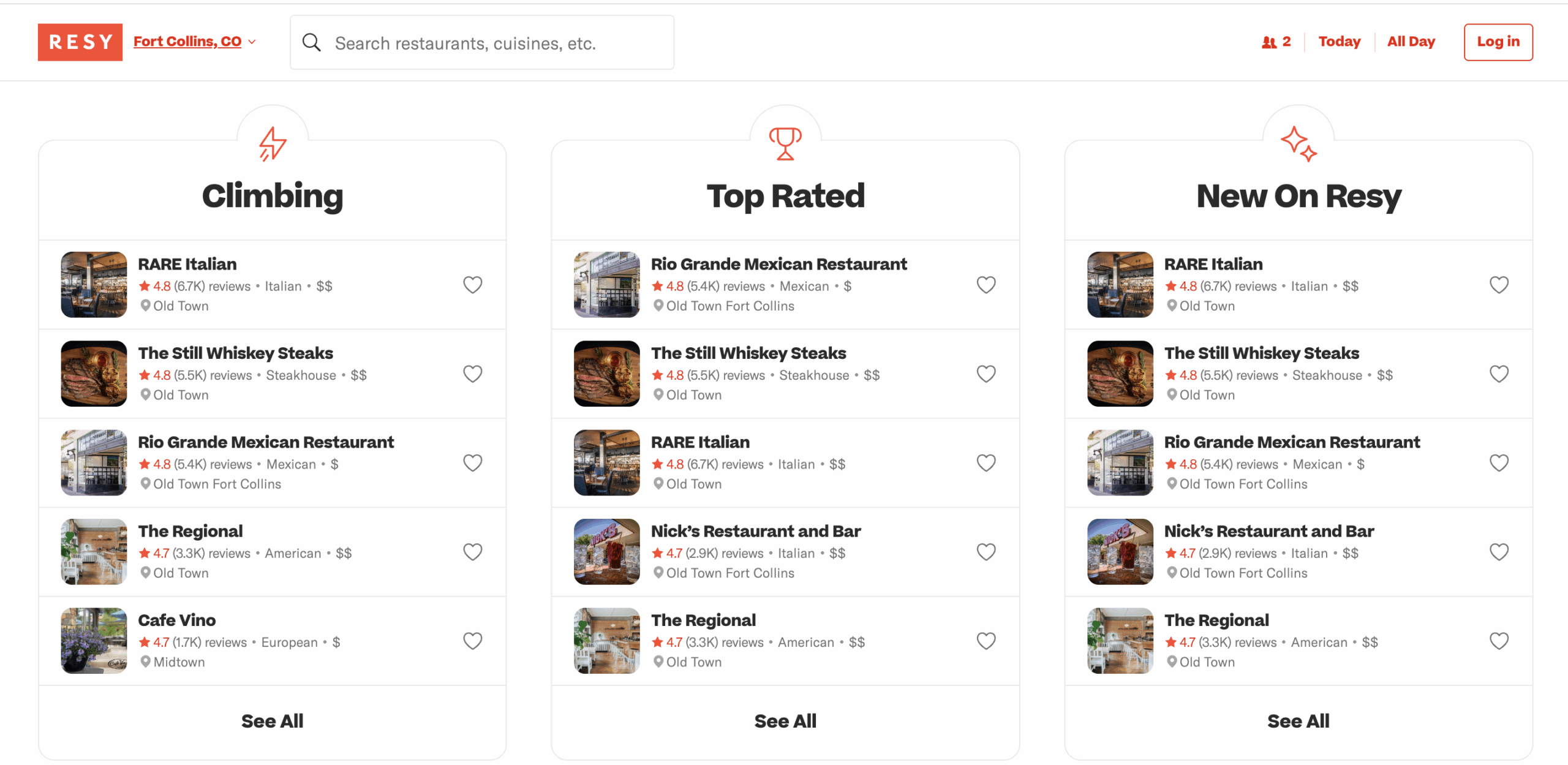

$400 Resy Credit + Platinum Nights by Resy

With Platinum Nights by Resy, you can get special access to reservations on select nights at participating in demand Resy restaurants with your Platinum Card®. Simply add your eligible Card to your Resy profile to book and discover Platinum Nights reservations near you. Plus, when you use your Platinum Card® to pay at U.S. Resy restaurants and to make other eligible purchases through Resy, you can get up to $100 in statement credits each quarter with the $400 annual Resy credit. I have found several restaurants near where I live that I often frequent, so this is an easy credit for me to use because I love to go out to dinner!

Enrollment required. Terms apply.

Lululemon Credit $300

When you use the card_name for eligible purchases at U.S. lululemon retail stores (excluding outlets) or lululemon.com, you can receive up to $75 in statement credits each quarter. That’s up to $300 in statement credits each calendar year. I love me some lululemon for comfy travel outfits, so this is a no-brainer!

Enrollment required. Terms apply.

Oura Ring Credit

Receive up to $200 back each year when you use the Platinum Card® to purchase an Oura Ring through Oura. Jess loves her ring, and I’ve been considering using this credit.

Enrollment required. Terms apply.

Why I Find All This Valuable

Yes, the annual fee is high. With the credits that I will actually use, they are worth over $2,200 though. That is before I have even accounted for any other credits, including my priceless airport lounge access. I am happy to pay this annual fee because my credits are worth more than the fee by almost a thousand dollars! 🤯

And there’s even more on top of all of these great benefits.

Hilton Honors™ Gold Status and Marriott Bonvoy® Gold Status

Just by holding card_name, you also get gold status with Hilton and Marriott hotel chains (enrollment required). Here’s what you can expect from those benefits:

Marriott Bonvoy® Gold Elite Status

- Upgraded room at check-in, subject to availability

- 25% bonus points on paid stays

- 2:00 pm check-out, based on availability

- Welcome gift of 250-500 points

- Complimentary wi-fi

Hilton Honors™ Gold Status

- Space-available room upgrades

- Two complimentary bottles of water

- Daily food and beverage credit or continental breakfast

- Fifth night free on award stays

- 80% bonus points on paid stays

Hotel status is another perk that makes every stay valuable and could make this card one worth keeping.

Miscellaneous Perks (read your documents for what is covered)

- $155 Walmart+ Credit (up to $12.95/month plus applicable local sales tax. Plus Ups not eligible.)

- No foreign transaction fees

- Plus several extra protections that you might want to have when you travel.

Points Earnings

One of the top ways to use your card is to pay for flights—earn 5 points per dollar spent on flights booked directly with airlines or through American Express Travel®, on up to $500,000 on these purchases per calendar year. This can add up. You’ll also earn 5 points per dollar spent on prepaid hotels booked directly on American Express Travel®. You will earn 1 point per dollar spent on other eligible purchases.

American Express Membership Rewards®

American Express Membership Rewards® are the points you earn when you use the card_name What we love about them is that they are transferable. That means you can transfer them to select airline and hotel transfer partners.

Airline and hotel partners include:

- Aer Lingus

- AeroMexico

- Air Canada

- ANA

- Avianca

- British Airways

- Cathay Pacific

- Delta

- Emirates

- Etihad

- Flying Blue (Air France/KLM)

- Iberia

- JetBlue

- Qantas

- Qatar

- Singapore

- Virgin Atlantic

- Choice Hotels

- Hilton Hotels

- Marriott Hotels

Not every transfer is 1:1, but many are. Additionally, there are often transfer bonuses so you can earn more miles and points for your Membership Rewards®.

You could fly on Emirates by transferring Membership Rewards®.

Bottom Line

The card_name is one of my favorite cards, and I derive significant value from its benefits. What are your thoughts? Are the benefits worth the annual fee for you? If you don’t take advantage of the credits, it may not be worth keeping in your wallet, but it is ALWAYS worth trying it out.

Opinions, reviews, analyses, and recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities.

For rates and fees of card_name, see Rates and Fees.

Related Posts

Podcast #47 Breaking Down AMEX

How to Transfer American Express Membership Rewards® to Airline and Hotel Partners

American Express Membership Rewards® Explained

American Express Family Language

What Can You Do with 75K American Express Membership Rewards®?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I just got an offer via email for 175000 welcome bonus (for 8k spend in 6months) and was so excited to snatch that up! I’ve been stuck in chase 5/24 restriction for quite some time and had been rejected for capital one venture so getting pre-approved and selected for this made my travel hacking year!

That is a great offer!