February 17, 2025

Are You Getting Your Best Points/Miles Redemption?

Pam

Nothing causes more analysis paralysis than this question, “Are you getting your best points/miles redemption?” You’ve done the work of earning all those credit card points and miles for that nearly free trip, and now you worry if you are doing it “right.” We see many messages in our Facebook group where people panic about whether they did their redemption “right.” Let’s review a few things today that might help you with that question.

Booking with Transfer Partners vs. a Portal/Using a Search Engine

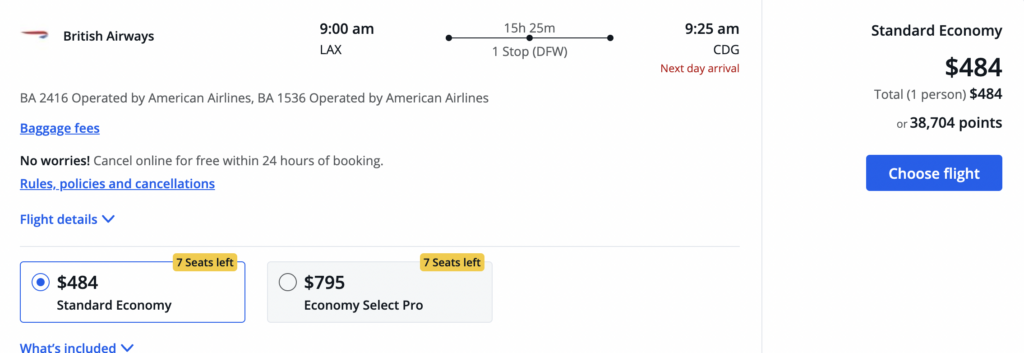

Generally, you will get more value from your points and miles by booking with transfer partners vs. booking through a travel portal. Sometimes, booking in a portal is all that will work for you, but usually, the best redemptions are made through transfer partners. Here’s a simple scenario of a one-way flight from Los Angeles to Paris in economy class on April 9th. The first is booking through Chase Travel℠, and the second through a transfer partner.

The best rate I found through Chase Travel℠

This example proves my point—using a transfer partner will usually save you more points and miles. There are typically a lot more options with transfer partners. Using a search engine showed me a completely different and cheaper flight than the one the portal showed me.

Checking out the Cents Per Point/Mile

There are some pretty standard formulas to determine if the value you are getting for your points/miles is above average. This can make you feel more secure about your redemption if you are getting a value of two cents per point/mile, that is considered a good redemption. You will usually get much more than that for business class redemptions.

If I was booking the Air France flight I used as an example above, here is what it would cost:

There is a quick calculator here that can help you determine these values. In our example, I plugged in the transfer partner redemption and the taxes and got nearly four cents/mile, which is a great deal. I can feel good about this redemption.

The normal cents-per-point valuation if you were to cash your points and miles out is one cent per point/mile. If you are getting at least two cents, you are doing well. However, you will NOT always get as much as in the above example.

Remember That Free is Free

This is a huge reminder that you might not always get the best deal out there. Remember that time is money, too, so don’t spend days running searches. “Am I getting my best points/miles redemption?” is not even a question I ask myself sometimes. If it works for you and your circumstances, then that is a huge win. Even we don’t always book the “best” deal. Recently, I used 143K points to fly from San Francisco to Singapore in business class on Singapore Airlines.

I couldn’t get the Saver Award, and I wanted to fly Singapore Airlines. I also had a healthy stockpile of points. This flight worked for my circumstances, and I didn’t lose sleep over whether I could have made a better redemption.

This redemption worked for me!

The flight would have cost me $4,772.00. When I checked the calculator today, I still got almost 3.5 cents per point. Could I have done better? Of course! But it was still a great redemption, and I loved it!

Bottom Line

Are you getting your best points/miles redemption? We all want to stretch our points/miles so that we have more for nearly free trips. Using the methods listed above, you can ensure that you sleep peacefully after making that award redemption. Additionally, remember that you can always earn more points and miles!

Related Posts

Should I Use Points & Miles or Cash to Book a Trip

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.