June 29, 2021

Five Top Tips for Staying Organized with Points and Miles

Alex

One of our frequent questions from beginner points/miles users is, “How do I stay organized?” This worry about organization actually keeps people from enjoying this hobby and the wonderful free travel it offers. Don’t let organizational worry paralyze you. It is actually super easy to be organized. Here are our five top tips for staying organized with your credit card points/miles.

1. Travel Freely

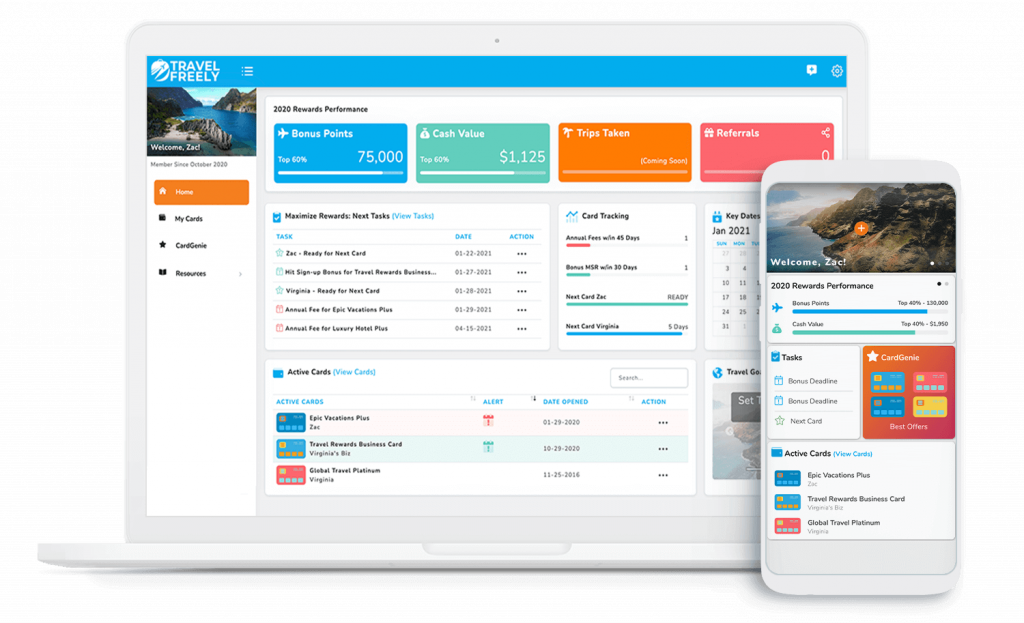

TravelFreely is an amazing FREE site to help you keep track of your credit cards. If you want to be organized, then you need this! They really excel at keeping track of your Chase 5/24 status. Since I am trying to get under 5/24, it is nice to know exactly when that will happen for my husband and me. Travel Freely also keeps track of when it would be a good time to open another credit card and will even suggest credit cards that would be good for you to open based on the cards you already have. I also love that it sends me a reminder when I have an annual fee due in time for me to decide if I want to keep the card or get rid of it after the annual fee posts.

It also reminds me of when I have to finish meeting my minimum spend or lose my bonus points. This is huge! It is an easy site to use. Enter the name of the card and the date you opened it, and let it do the rest! We have a whole post all about Travel Freely that you can check out!

Travel Freely also has a mobile app! It makes it so easy to quickly check out my cards, 5/24 status, and see any annual fees that are coming up. I spend most of my time on my phone vs. computer, so having the mobile app has been so nice!

Travel Freely website and mobile app homepage.

2. AwardWallet

AwardWallet is another great free service that every points/miles user should use to stay organized. It keeps track of all of your points/miles in one place. If you have various loyalty accounts, it can be very helpful to view your points all at once. It also notifies you if your points are nearing their expiration date. Award Wallet is a free service, but you can pay to upgrade to a premium version. Having Award Wallet to keep track of all my points is huge and definitely makes our list of top tips for staying organized with points/miles.

It is very simple to use. Here’s how you use it:

- One by one, add each credit card you and each family member have on the site

- Include your login information for each credit card so they can track your points

- They will track your points weekly and email you your current total

- There are a few cards they don’t have access to and you can manually enter their totals periodically

- You will also receive info about upcoming flights

- You can access your loyalty accounts on the site easily without remembering numerous sign-ins and passwords. I love this feature.

- The service is free for all of this!

In addition, you can upgrade to a paid version for only $30/yr. I have done this and am so glad I did! The upgrade gives you:

- Expiration dates of all points, and they email you when the dates are getting near. I have literally saved thousands of points with this feature. That email reminded me I needed to use a particular credit card I had put away so that my expiration date was extended another year. Seriously, the upgrade is worth the whole program!

- Other features, but they pale to this point saving one!

4. Use CardPointers

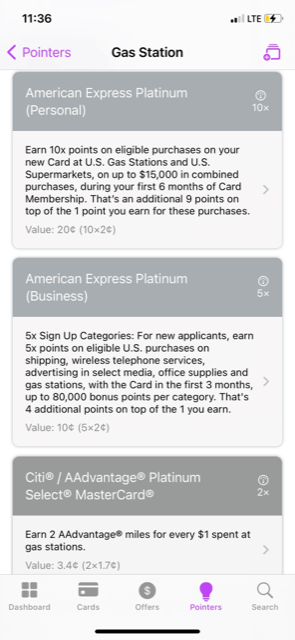

Not meeting minimum spend on a card right now but want to know that you are using the card that will get you the most points for your purchase? You no longer have to memorize which card to use for gas or groceries or put sticky notes on each card to let your spouse know. Download an app called CardPointers and let it do the work for you.

For instance, I needed gas and wondered which card I should use. When I open my Cardpointers app, I see this:

The cards I have are linked to let me know which is the best card I should use to get maximum points. In this instance, I would use The Platinum Card® from American Express for 10x points at gas stations. Wow, that is an awesome redemption. If I didn’t have this app, I might use the wrong card and miss out on points. Thanks, Cardpointers, for being one of our top tips for staying organized.

4. Phone Reminders, Email Notifications, and Automatic Payments

I have reminders for all the cards I currently use on my phone, so I never forget to pay them off. The reminders are set to go off monthly and about ten days before the bill is actually due. I find the phone reminders work well, and because I don’t use that many of my cards, it’s pretty easy to keep track of.

I also get an email sent to me when my statement closes for each card, a reminder ten days before the bill is due, and an email confirmation when I pay the bill. I like having this as a backup to my phone reminders.

Another great idea is to just make your payments automatically through your credit card company. I do this with several cards I use less often, which works great. If you worry about forgetting and missing a payment, just set them up for autopay right when you get them, and don’t even worry about it!

5. Don’t Use All Your Cards

There is a common misconception that because I have a lot of cards, I have all these credit card bills I need to pay off each month. I sign up for many of my cards strictly for the welcome bonus and don’t use them much after meeting the minimum spend. Because of this, most of my cards actually sit in a drawer. I get the card, use it to meet the minimum spending requirement, and then tuck it safely away.

If I am not working on a new card, I use one of my Ultimate Reward® earning cards. Those are my go-to everyday cards. Using just a few cards makes it easy to track it all. My mom has more cards than me, but many are tucked away in a sock drawer. This is a major player in our five top tips for staying organized with credit card points/miles.

Don’t carry all your credit cards with you!

Bottom Line

Don’t overthink organization! Use our five top tips for staying organized with credit card points/miles! Get some really good apps like Travel Freely, Award Wallet, and CardPointers, and let them do the work for you. They can keep track of everything that is important to know. Then set up some reminders for payment dates or automatic payments, and that’s it – you are organized!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.