April 12, 2023

How to Use Credit Card Points and Miles

Pam

There are so many ways that you can use credit card points and miles, and credit card issuers constantly give you ideas. Not every idea is a great point or mile redemption, so let’s go over the do’s and don’ts of credit card point redemptions.

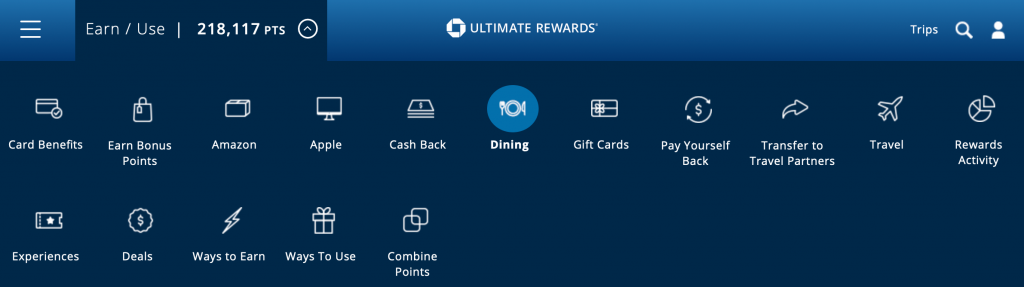

All the ways I can redeem my points, both good and bad redemptions.

How NOT to Use Your Points

Shop at Amazon

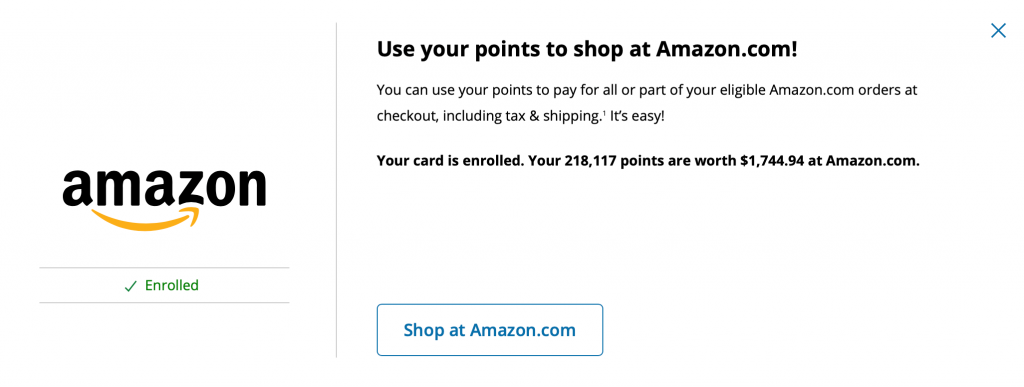

Chase and other card issuers, like American Express, gleefully encourage us to use our points for shopping at Amazon. We all probably shop at Amazon quite often, and free merchandise is always great, right? Wrong! Here’s what Chase says I can do with my points at Amazon:

As tempting as $1700 worth of free merchandise sounds, I know that those 218,000+ points can buy me 3 one-way business class tickets that would be worth about $15,000+. I fly internationally and love to fly business class, so I think I will pass on the Amazon offer.

If I wanted to stay in Hyatt Hotels, those points could get me 7 nights at a nice property like the Hyatt Regency Kaanapali Beach worth $600/night or more. That is worth $4200, so I would prefer that also. The basic category 1 Hyatt Hotel goes for 5,000 points a night. I could stay 40 nights with my points! I will definitely not be using them at Amazon. In my book, Amazon is not a good use of my points.

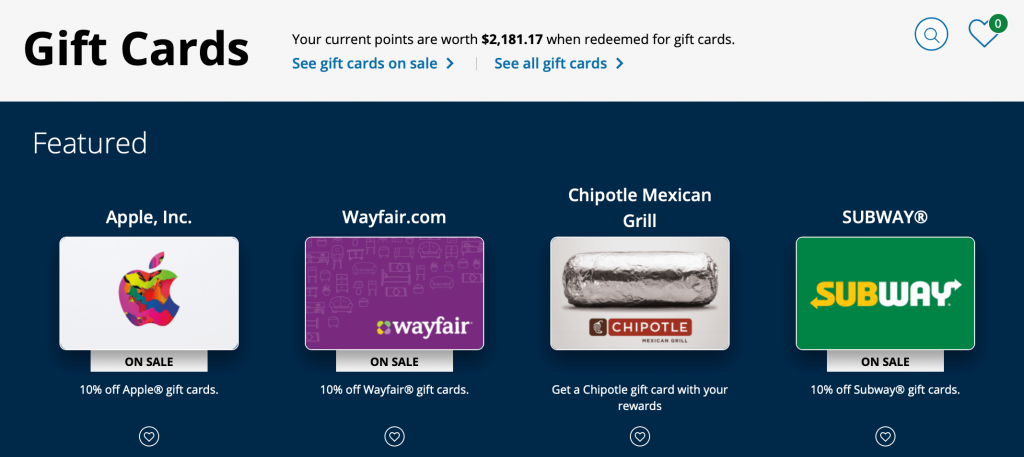

Gift Cards

Free money in gift cards sounds like a great idea too. I am sure that this works for some people when money is tight. However, I am in the credit card points and miles game for travel, and I prefer to use my points that way. The do’s and don’ts of credit card point redemptions don’t include redeeming my points for gift cards.

Essentially, the credit card issuers give us 1 cent per point, which equals $2000+ worth of merchandise, gift cards, etc. If we book in Chase Travel ™, we are guaranteed 1.25 cents per mile, which makes more sense. If we transfer points to a travel partner, we can do much better on business seats and hotel redemptions, as in my example above.

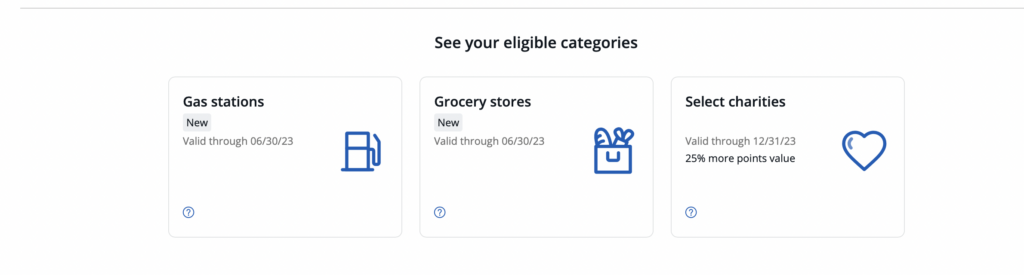

Pay Yourself Back

This can be a good option when someone has a job loss, illness, or other setbacks. It could also be an option when you travel anyway and need the money but have no plans to travel. However, I do this hobby for travel options, so it isn’t something I would do. This option allows you to redeem your points for a statement credit with different redemption categories.

Better Ways to Use Your Points

Transfer to Travel Partners

This is my favorite way to use credit card point redemptions. Usually, I get much more value for my points when I do this. Both American Express and Chase often have transfer bonuses , and that is when I can really save. I recently traveled to Greece, and I could have booked my business seat with United Airlines with points that would cost me 77K points. Instead, I transferred American Express Membership Rewards® to Avianca and booked the same flight on United for 65,000 points.

Even if you just want to travel domestically, you can often save more by transferring your points rather than booking travel through the travel portals. It is always a good idea to check both ways, but if you need to cancel a booking, it is generally easier to book directly with transfer partners.

Book in a Travel Portal

Booking through travel portals is similar to booking through a third-party travel site like Expedia. We always recommend checking and comparing the portals because you can sometimes find some good deals. If you are looking for domestic travel, you may find more options for your points in a travel portal. We almost always transfer to a transfer partner, but this is still a good option and easy for a newbie.

Bottom Line

Although there are many options for using credit card points and miles, the best options are transferring to a transfer partner or booking through a portal. You will get more value for your hard-earned points when you use them in these two ways.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

what is a travel portal? Id like to use my American Airlines points to go to Rome and optimize them for business class+ but dont seem to be figuring out the best way to do so. I also have an amex card with points that hopefully I can transfer over..

All of the transferable currencies, Chase Ultimate Rewards, Capital One Venture Miles, American Express Membership Rewards, and Citi ThankYou Points have travel portals that work like Expedia that you can use to book travel. With AA miles, you can only use them on the AA site. You can definitely use your Amex card and transfer points to one of their partners for travel but be sure and find a flight available before transferring as they are one-way transfers. Here’s more info about AMEX partners: https://travelmomsquad.com/american-express-membership-rewards-explained/