September 9, 2021

Is it Worth Buying Points and Miles?

Pam

Did you know that you can actually buy points and miles? Have you ever done it? Is it worth buying points and miles? I think there are a few instances that it is worthwhile. Let’s talk about some of them.

You Don’t Have Points/Miles Yet

Let’s say that you are a newbie that doesn’t have any points/miles yet but wants to travel cheaper. This might be a time you would buy points/miles on a sale because they might be cheaper than just purchasing a ticket.

Both airlines and hotels offer periodic sales on their points or miles. Sometimes these offers are really good, and you could save on getting a ticket this way vs. an outright purchase. United, Alaska, IHG, Hyatt, and Marriott offer frequent sales. So does Life Miles, and I have bought some points from them to travel cheaply on Star Alliance airlines, most notably, United Airlines.

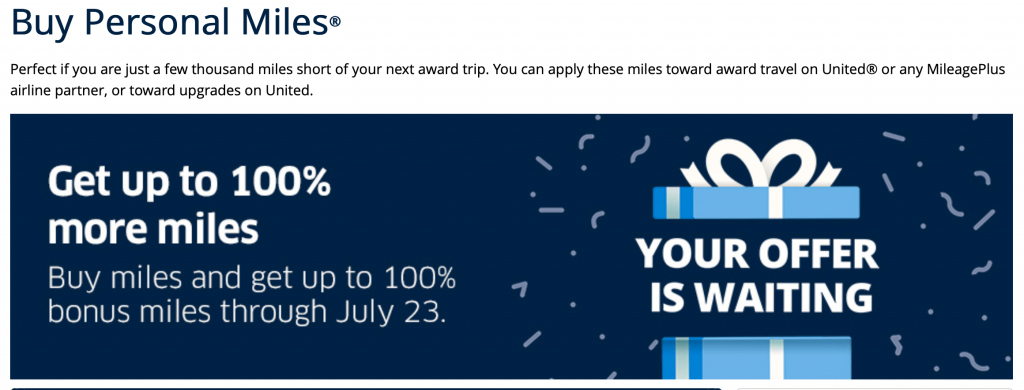

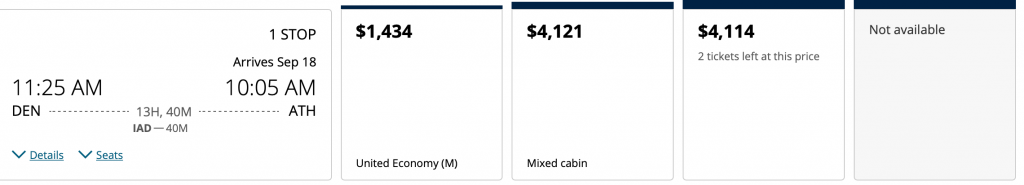

Let’s look at United Airlines and a past sale on their miles:

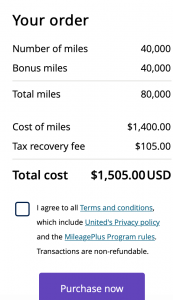

Note that to get the 100% bonus, you must buy at least 40,000 miles. If you buy less, you will only get a percentage of that bonus.

You can see that you have to pay a fee, but for $1,505, you can get 80,000 United miles. A one-way business class ticket from Denver to Athens would cost me over $4,000, but I could buy the miles on a sale and only pay $1,505. This same flight would cost me 77K United miles + $27 in taxes/fees. Of course, that is how I would pay for it, but if you don’t have miles yet, you might want to price out if you could save by buying points/miles.

Looking for Points/Miles Sales

The easiest way to check if buying/points and miles is worth it for your situation is to do the following:

- Check out what airline or hotel you plan to book

- Go to their website and check if that airline or hotel currently has a sale going on.

- Compare the cost of booking in cash with the cost of purchasing the miles/points on sale to decide if it is worth doing

You Need Just a Few More Miles/Points

Sometimes you may have 25,000 points in a program but want to book a flight or hotel that is 30,000 points or miles. At that time, it may be worthwhile to purchase the 5,000 extra points/miles (especially at a sale price) to give you enough. This is especially true if you don’t have time to either earn those extra points or sign up for a card that will give you those points.

Buying some points might let me stay at the Hyatt Regency Maui if I am short just a few points.

You Have a Big Minimum Spend

While I don’t recommend doing this unless you have to, I have bought some miles to an airline that I use a lot or that I love to fly on, to help me meet a minimum spend. LifeMiles is one that I have done this with. It is a Star Alliance member, and I have found good redemptions with them for flights to Europe. Because of this, I occasionally buy some of their miles when they have a great sale, and I am trying to meet minimum spend.

This isn’t the best practice unless you have a definite use for the miles because the points or miles can devalue, but it has worked for me so far. Rather than lose my bonus because I am not going to meet the minimum spend, I would prefer to buy some miles that I will use anyway.

Bottom Line

So is it worth buying points/mile? At first glance, you may have said no. However, when a great sale is going on, it can be worth the expenditure. Having a plan on how you are going to use them decreases the risk of a speculative purchase, though. Using a credit card like the Capital One Venture card that earns 2x points on all purchases can also make it beneficial. Unfortunately, you will not usually get extra points for cards that have a higher rate for travel purchases.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.