August 30, 2021

What to Do if You are Over 5/24?

Pam

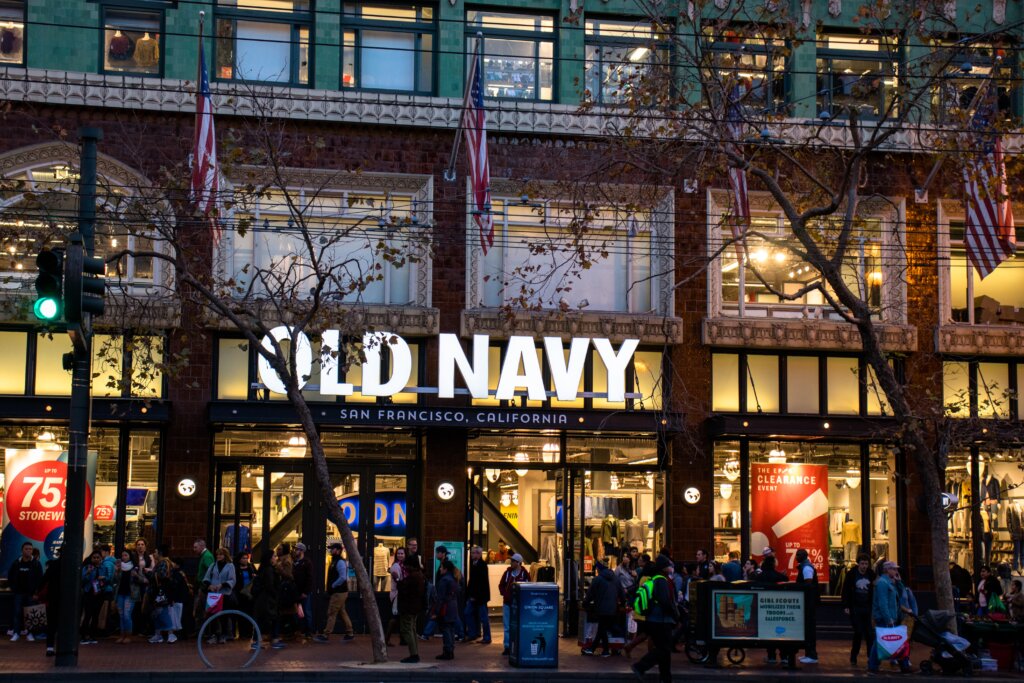

Just say NO to store credit cards! What, but they are credit cards! I might get $20 off my $100 worth of clothes when I check out if I get this Old Navy credit card! What’s the logic in that?

I hope some of you are laughing and totally know what I am talking about. I remember the day a couple of years ago when my husband came home from Home Depot proudly telling me he had saved some money by signing up for their credit card. He was surprised to find that I was less than thrilled. The reason being this card now occupied one of his Chase 5/24 slots. Today, we’re going to talk about the Chase 5/24 rule and what to do if you are over it.

Resist applying for that Old Navy credit card that will take up one of your Chase 5/24 spots.

Remembering 5/24

Just in case some of you are wondering what all the hoopla is, let’s talk about the Chase 5/24 rule. Chase is one of our favorite card issuers, but they have this (obnoxious) rule that they will not approve you for ANY of their cards if you have opened five or more cards in the last 24 months. That means not just their credit cards but cards from other issuers as well, like Amex, Citi, and those random store credit cards.

We like to keep ourselves open to Chase credit cards because they have many great offers. Two of the most recent Chase offers that we liked were:

I already had the Chase Sapphire Preferred but didn’t have the Quest card. Because I travel on United Airlines a lot, I was really happy I was under 5/24 so that I could get that card.

I’ve talked to several people who want to get into the points and miles world, but within the last 24 months, they’ve opened up 4-5 store credit cards. That makes it harder but not impossible. What do you do?

What if I’m Over 5/24?

First of all, start saying no to any more store credit cards. The amount you save is not near the amount you will save on travel with credit card points! Don’t let those cards take up one of your 5/24 spots any longer.

Business Cards

If you are at 5/24 or over, then start applying for business cards. Typically, business cards do not count towards 5/24, with the exception of Capital One, Discover, and TD Bank business cards. However, the Capital One Venture X business card and Capital One Spark Cash Plus card DO NOT count towards 5/24 status.

You won’t be able to be approved for Chase business cards, but those issued by Amex, Citi, Bank of America, etc., are all fair game and won’t count toward your 5/24 count. If you are at 4/24, you may also want to consider going for business credit cards to keep that last spot open in case a great Chase offer comes along.

One last thing about business cards and 5/24 that can trip people up. Chase business cards do not count towards your 5/24 count, but if you are at 5/24 or over, then, you won’t be able to be approved for Chase business cards.

Time to Move on to Your Spouse Applying

If you have a spouse or partner under 5/24, now is the time to have them apply for some of those Chase cards you can’t apply for. Playing this game in 2-player mode is crucial to getting more travel points/miles. You don’t have to worry about what to do if you are over 5/24 and have another person in the family who isn’t.

Take a Break

You might need to take a break from credit card applications while you get under 5/24. My husband and I both did this for 9 months once because we were both over 5/24, and I REALLY wanted at least one of us to be under. I have to say; it was HARD. I hated not to be getting those big bonuses even though I had a very healthy stockpile of points. It’s that crazy feeling of scarcity when you don’t have it.

We continued to use the best credit cards we had for every purchase we made for everyday spending and continued to earn points. And more importantly, I survived, and we were able to start getting Chase cards again!

Continue using the cards you already have for your everyday spending so you continue to get points.

Move on to Another Issuer

Chase is not the only player when it comes to credit card issuers. There are still plenty of credit card issuers to choose from like American Express, Citi Bank, Barclays, Bank of America, US Bank, and more. The reason I was over 5/24 is that I was opening a lot of credit cards. That is also why I had so many points and didn’t really hurt to miss out on Chase cards for a while.

Seriously, you just may want to start applying for a lot of other credit cards by other issuers, forget about Chase 5/24 for a bit, build up a stockpile, and then take a break to get under the Chase 5/24 rule.

Or if you’ve already received all the Chase cards you want, move on. So many people worry that they will run out of credit cards to apply for. I’ve been doing this for over 4 years, received over 6 million points, and feel like there are TONS still to get. And then there are some I can get again, so that is not something I worry about anymore.

Bottom Line

If you play the game of points and miles long enough, there will be times you are over 5/24. Or your spouse/partner will be. Don’t worry about what to do if you are over 5/24. Follow one of our tips above and continue earning points towards free or nearly free travel!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Question- if you wanted to get back into the chase game after having been 5/24, do you take a break for 24 months from opening up any new cards?

I just concentrated on opening non-Chase business cards during that time.

Chase has denied a business card application for me and my wife, but I don’t understand because the only cards we have opened in the last 24 months are business cards. We are stuck because we still need to finish up collecting miles for the SW Airlines companion pass. What should our next steps be?

They still know that you have their business cards even if it isn’t on the credit report. They have gotten very stingy with business approvals. I would move on to their personal cards or other issuers business cards. Sadly, many people are in the same boat, including me! 🤦♀️

Hi! Thank you for all the information!! I apologize if I missed this on the blog or Facebook but couldn’t find the answer! If you go over 5/24 and continue to open personal cards would you just further put yourself into 5/24 debt, meaning you open 2 additional personal cards, so if I was over at 7/24 would you have to wait for 3 cards to come off to be under 5/24?

Thank you!

That’s exactly right! We’ve all gone over 5/24 sometimes.

Thank you!

My husband and I have both gotten denied Chase cards in the past month. I am at 4/24 and he is at 3/24, but they say we have opened too many cards. I don’t know what to do???

I would move on to another bank issuer like Capital One or AMEX and come back later to them.