August 4, 2022

Purchasing IHG Points: Does It Make Sense?

Pam

I just saw a deal about purchasing IHG points with a 100% bonus. I have to say, that usually, purchasing points doesn’t make sense. We talked about purchasing points in a previous post but I’m wondering, does it make sense this time? I’m working on a $15,000 minimum spend on The Business Platinum Card® from American Express so I want to get some more of that out of the way. Should I purchase IHG points to help meet my minimum spend? Let’s look at a couple of options.

You are actually purchasing these points for 0.5 cent per point and most people value them at 0.8 cents a point. Okay, not too shabby. This sale does happen a couple of times a year so you don’t have to run out and do it this time if you don’t want. I just happen to want to meet my minimum spend. Let’s look at a couple of redemptions to see if it is a good deal. Remember that award stays come with the 4th night free.

Kimpton Seafire

Alex and I are heading to the Kimpton Seafire in the Cayman Islands in March. Alex had points for 2 nights but not enough for the 3rd night (getting the fourth night free is a benefit with the card_name – Redeem 3 nights, get 4th night free when you redeem points for a consecutive four-night IHG® hotel stay, you can receive a fourth Reward Night free redeemable at that same hotel during that same stay.). She bought 70,000 points the last time there was a sale to get that 3rd night on points (and thereby a 4th night!) and it made absolute sense. This is supposed to be an amazing property so let’s start from scratch and assume you have no points.

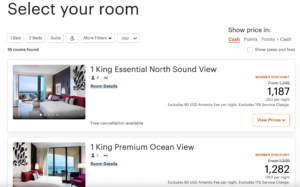

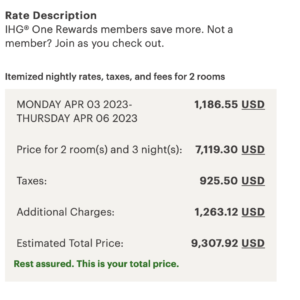

Yikes! Below, you’ll see the total cost of a three-night stay. What I can’t believe is the taxes and service charges, too!

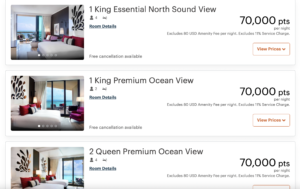

Okay, let’s see what the cost is with points. Remember that we will get a 4th night free with an award booking IF you have an IHG credit card. So we can stay 4 nights for 210,000 points.

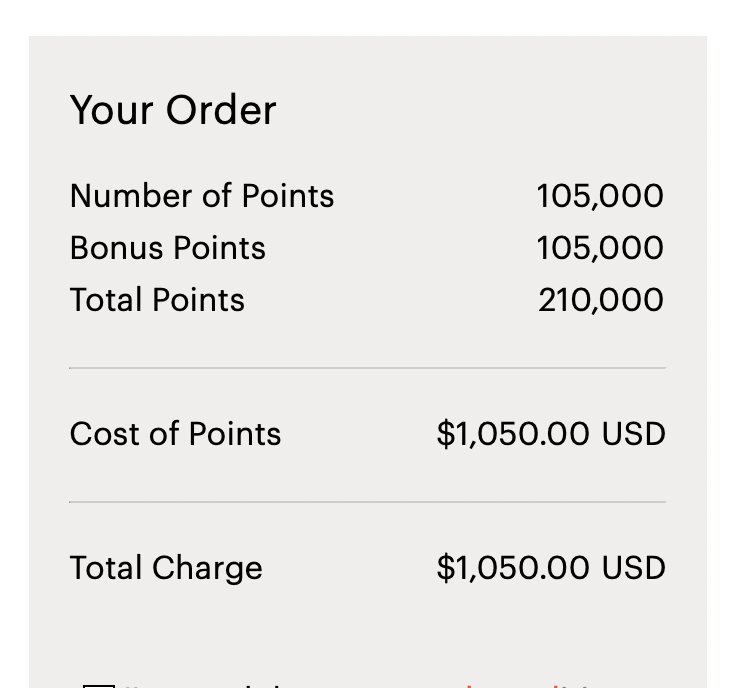

To get 210,000 points to book this stay, I would buy 105,000 points because I will earn 105,000 points.

Buying these points is actually just the cost of staying one night here if I was paying cash. I think this is totally worth doing if you don’t have the points from the card_name to stay here. This makes each night only about $250/night for a very luxurious stay. Would you buy points for this stay?

Looking forward to my stay at the Kimpton Seafire in the Cayman Islands in Spring!

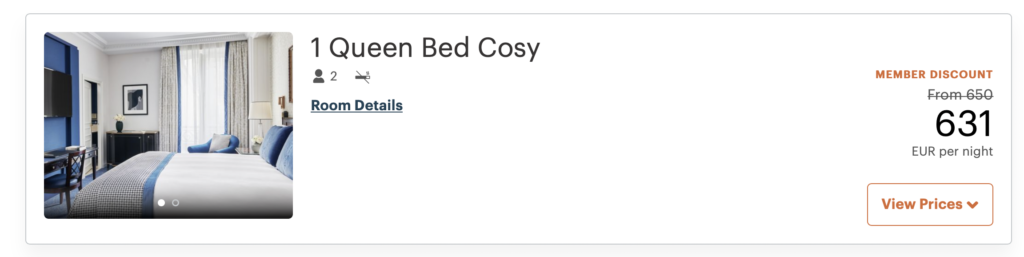

Intercontinental Hotel Paris – LeGrand

Let’s check out another option for using IHG points. Many of our readers are planning trips to Paris in the future with points and miles. Here is the normal cost in cash for a stay here:

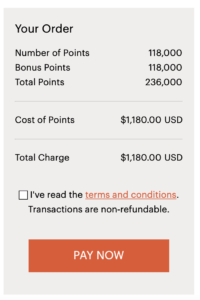

That four-night stay would cost $1,922.20 (some nights were cheaper than the nights pictured above. The price in points would be 236,000 total points (the average of nights is 78,000/night). We can purchase those points for $1,180.00. Staying here for three nights was $1,922.20, so buying points if we don’t have them definitely makes sense.

This looks like a beautiful room in Paris!

Bottom Line

When starting out your credit card points and miles journey and don’t have the miles or points you need, it sometimes makes sense to purchase points when they are on sale. Just make sure to do the math to see if it’s a good deal for you. In these two examples, purchasing IHG points really does make sense if you haven’t earned the points with a credit card. Will I be purchasing points? I can’t decide!! There are amazing IHG hotels throughout Europe and Asia, so I may!

Related Posts

Is it Worth Buying Points and Miles?

Head to Head: Kimpton Roatan vs. Kimpton Seafire

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.