September 27, 2022

Should I Use Points & Miles or Cash to Book a Trip

Pam

One of the frequent questions we get asked is, “Should I use miles/points or cash to book a trip?” Obviously, this depends a lot on your individual circumstances and what you want to do with your points. Ask yourself some of the following questions:

- Can I afford to pay for the flight and just get more points for booking it with cash?

- Do I want to save my points for a particular trip?

- How many miles/points do I have in my stockpile?

- Do I have an emergency travel plan?

- What’s your travel style?

- What is my points/miles plan?

It’s important to note that the best redemption is the one that gets you where you want to go and saves you money. Don’t get hung up on squeezing every last bit of value out of each point. There is no “right way to use credit card points and miles”.

Paying Cash and Getting More Points

There is nothing like the thrill of getting on a plane or booking a hotel and not paying for it! However, it doesn’t always make sense to use points all of the time. When I find a cheap flight, I tend to save my points for a costlier flight and book a cheap flight with cash.

One year my daughters and I decided to meet in Florida in April and the flight was over $400. Because I had quite a few United Airlines miles, I decided to book an award flight. We also used points for our hotel stays because we could book a Ritz-Carlton. It totally made sense in this instance to use miles/points for a luxurious, but cheap stay.

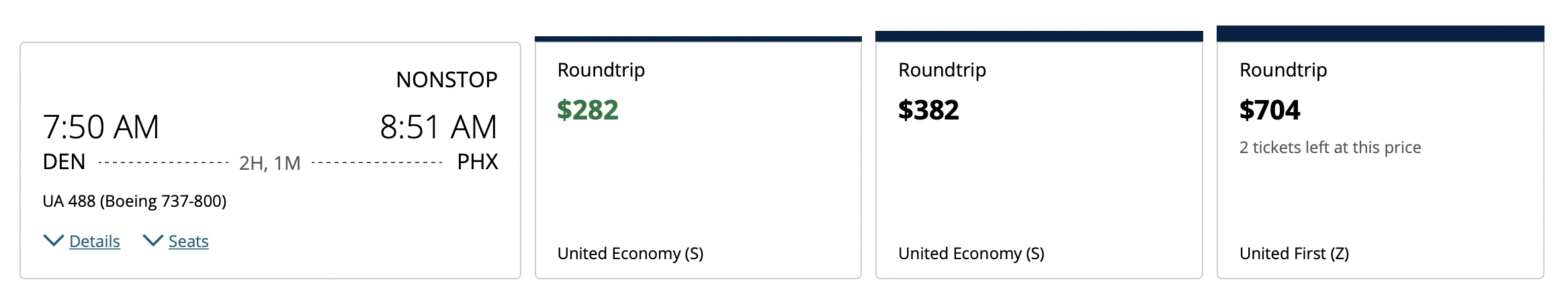

There is also something called CPM or cents per mile that you can use to decide if cash is better than points. I just looked up a flight going to Arizona in April. It is a $382 roundtrip from Denver on my chosen flight. I am wanting to take the $382 flight as the cheaper flight is just basic economy. Use this equation when figuring out the CPM: Cash price of flight/ cost of the same flight in miles = cents per mile (CPM)

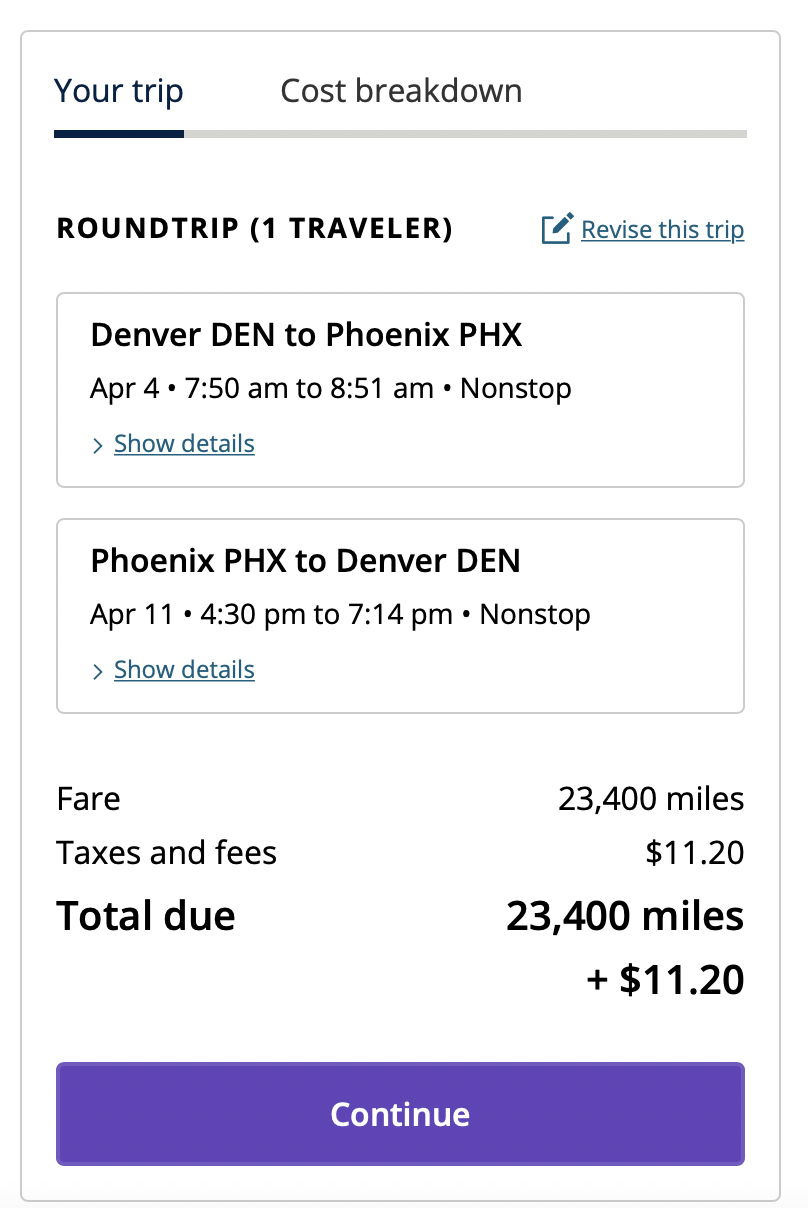

Let’s check out the miles to fly that same flight:

It’s 23.4K roundtrip plus $11.20. That means if I divide the $382 by 23,400 I get 1.6 cents a mile. I like to get at least 2 cents per mile so this is close to a good redemption for me.

I use the same idea for booking a hotel. If it is around $150, I’ll pay cash. I save my points for rooms that are over $200 usually. There are no absolute rules – you do you!

Saving Points For a Trip

I will often pay for a cheap trip because I want to save points for a particular trip that I know will be more expensive. Planning a trip to Hawaii? Want to go to Mexico? Itching to see Europe? All of those trips will cost more than my cheap flight to Arizona and I have plans for each of them. I would much rather save my valuable points on those trips than use them up on a short, cheap flight in the U.S. The question of whether I should use miles/points or cash to book a trip should always include your future plans in the decision.

We suggest that everyone plan a great trip (or two) each year. Don’t be short-changed when you go to book that trip because you used points on a trip that would have been better to use cash on. You can always buy a few more points but those are usually more expensive plus you have fees associated with them.

My sister and I have a planned trip to Greece for the Fall so I am saving points/miles for that trip.

Stockpile Status

An important consideration when considering using miles/points or cash on booking a trip is the status of your stockpile. Do you have points to burn or are you just getting started? Although I have a ton of points, they are scattered over a variety of airlines, hotels, and transferable points. I tend to get a little stingy on using points/miles when I see it start dwindling.

If you are just getting started in credit card points and miles, you might want to consider how many points you have before you start using them. You might be more inclined to cash vs points/miles if you are working on meeting the minimum spend on a new card.

Emergency Travel

Traveling at the last minute can be very expensive. If you have an older parent or sick relative, you may want to reserve some points/miles for an emergency visit somewhere. I certainly recommend having enough points to cover a domestic round-trip ticket at all times in your stockpile. Saving some points/miles to use to book a trip at the last minute instead of cash is a definite money saver.

Travel Strategy

What’s your travel strategy? Do you plan to use miles/points for domestic or international travel? If you plan to travel primarily domestically, your points will go further because it is cheaper. You can probably afford to use points more often versus cash. If you are fine traveling in economy class the same holds true.

Is luxury calling your name (think business or first class seats)? If international travel is your thing (or you want it to be your thing) then you will need to save those points and miles for that travel as it is more expensive. Even traveling in economy class is more expensive if you travel out of the continental United States.

My preference is to use my points for luxurious travel and the one nice thing is that I get so much value for using my points this way. I could use 30,000 points to travel round-trip to Florida in economy class and get about 1.3 cents per mile used. If I fly one-way to Paris, I’ll use 66K to fly in Business on a Saver Award (always look for saver awards) that would cost over $4,000. When I do the CPM equation, I get 6 CPM! Bingo! That is a good deal – way better than my Florida trip! That is why I tend to pay cash on cheaper flights.

If family travel is your plan for right now, that same 66K business class seat to Paris can possibly get you three round-trip domestic tickets! It all depends on your travel style right now.

Credit Cards Points and Miles Plan

Knowing what your points and miles plan is can help you decide whether to use miles/points or cash to book a trip. If you have plans to keep opening more and more cards, you will be more inclined to use more points. Do you have a spouse so that you can work in 2-player mode? If so, you will have the opportunity to earn more points in the future too.

If you are just trying things out, plan to get a card or two and see how it goes, you will probably want to be a little more conservative in award redemptions and plan for a big one.

Bottom Line

Ultimately, no one can tell you whether you should use miles/points to book a trip or use cash. We’ve given you some guidelines that we find helpful but it basically is all up to you. Free or nearly free is always AMAZING! Take some time and figure out what your goals are for your travels. Use those goals to help you decide what works for you. It may not make sense to anyone else, but it works as long as it makes sense to you! Let us know if we can help you!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.