October 18, 2022

Using Your Credit Card Like a Debit Card

Pam

Using your credit card like a debit card is the way to meet minimum spending and earn a lot of nearly-free travel. Remember when we used to use checks to pay for things? So old school, right? Then we changed over to using a debit card for most of our purchases, and that was such a time saver!.

Well, now we need to put away those debit cards that earn zero points—nada in points. The same goes for cash—no points. We want to use our credit cards like we used to use our debit cards to pay for everything we possibly can!

The fastest way to earn many points is by signing up for credit cards that offer a big welcome offer. You want to use that card on every possible purchase to meet the minimum spend on that card and earn those points. From $1 to $1,000, it all adds up!

Change Over Your Automatic Payments

Like me, you may pay your phone, cable, internet, and electric bill via automatic payments. Not only does that ensure that I get them paid on time, but I also get valuable points for paying them with my credit card. Whenever I change over the card that I am trying to meet the minimum spend on, I take a few minutes (and it literally takes just minutes) and change over the credit card I use for those automatic payments. This greatly affects my ability to make my minimum spend quicker!

Use Cardpointers

If you are not meeting the minimum spend on a card right now, you still want to know that you are using the card that will get you the most points for your purchases. You no longer have to memorize which card to use for gas or groceries or put sticky notes on each card to let your spouse know. Download an app called Cardpointers and let it do the work for you.

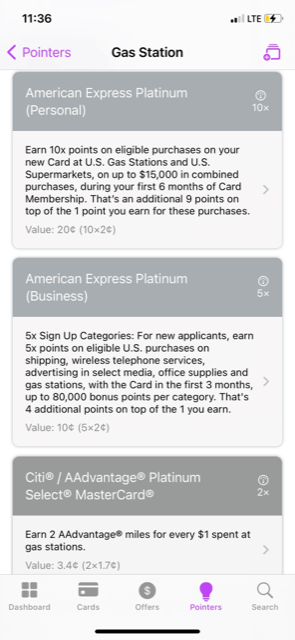

For instance, I need to get gas and wonder which card I should use. When I open my Cardpointers app, I see this:

The cards linked to my Cardpointers account tell me which card I should use to get maximum points. In this instance, I would use my The Platinum Card® from American Express for 10x points at gas stations. Wow, that is an awesome redemption! If I didn’t have this app, I might have used the wrong card and missed out on points. And what if I’d used a debit card? Major point miss! Using my credit card as a debit card helps me gain so many more points for travel!

Stay Out of Debt

Another great reason to use and treat your credit card like a debit card is so that you don’t get into debt. With your debit card, you only have the amount of money in your checking account at your disposal. Think of your credit card the same way, so you don’t overspend! Some people pay off their credit cards every time they make a purchase. That seems like a lot of work, but it could help you avoid spending more than you have. I never spend more money than I have in the bank. And I always pay my cards in full each month.

Bottom Line

STOP if you are still using checks, cash, or a debit card to pay for purchases. Use your credit cards like debit cards and quit missing out on all those valuable points that will help you get on your next vacation!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.