August 31, 2022

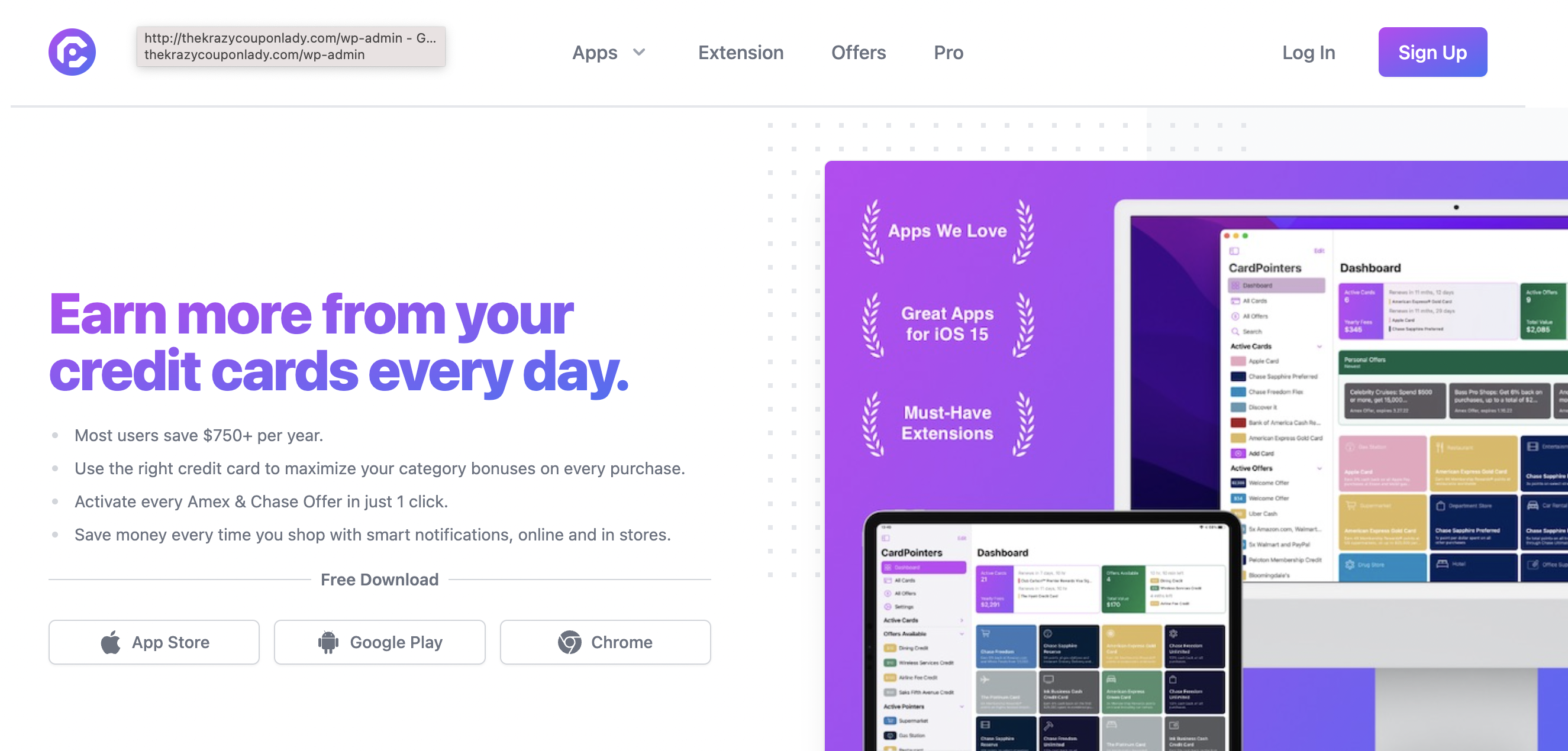

5 Reasons I Love the CardPointers App

Pam

We love apps to help keep us organized with our points and miles. Travel Freely is our #1 favorite free app and it keeps us on track with our 5/24 status, when annual fees are due, and if we are meeting our sign-up bonuses. We also love Award Wallet to keep track of our point balances and expiration dates. Another amazing app is CardPointers. Here are 5 reasons I love the CardPointers App.

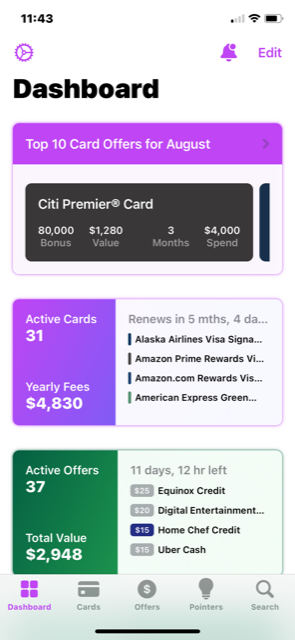

The Dashboard

The dashboard is where I can find almost everything in one place. My active cards and how many I have are listed there. I can also find the following info on my dashboard:

- The total I spend on annual fees

- When a card is going to renew – this gives me time to call and see if I can get a retention offer or whether I want to keep, cancel, or downgrade the card.

- List of active offers (or benefits) along with the time I have left to use them.

- My 5/24 status.

At the bottom of the dashboard, I can add any new cards that I might apply for. Every time I get a new card, I take a few minutes to add that card to my card list. I can also delete those I may cancel (not many).

I can click on individual cards on the dashboard or cards section to get a synopsis of my individual cards. This includes when I was approved for them, their benefits, and when I earned the signup bonus. This is super helpful to see so I can decide if it’s been enough time for me to reapply and get the bonus again.

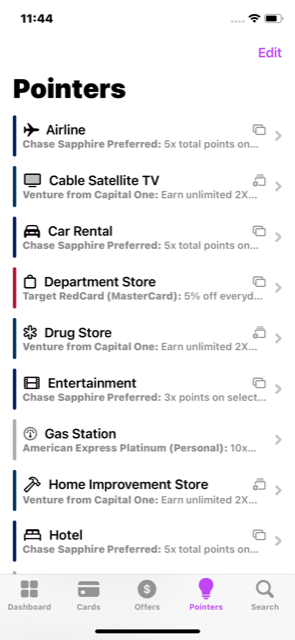

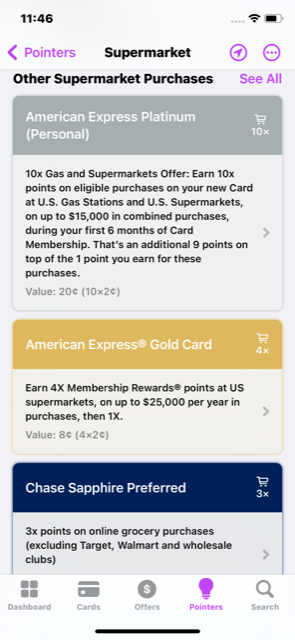

Category Spend Pointer

Ever wonder what is the best card to use when you are grocery shopping or pumping gas? With CardPointers, you don’t have to wonder anymore. Once you’ve listed the cards you have in the app, it will tell you which card to earn the most points or miles in each category. Just open up your app and when you tap “pointers” at the bottom of the app, this is what you’ll find. This is tailor-made to my cards so yours could look different.

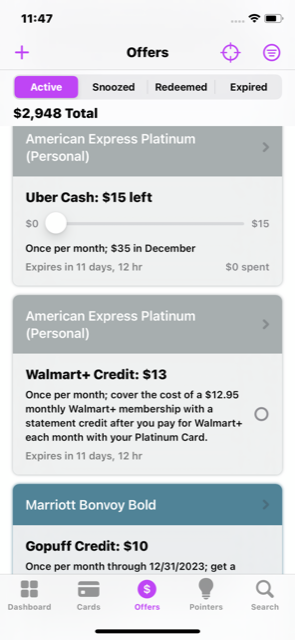

Keeps Track of Benefits Used

Almost every card has benefits that come with it. Are you using your credit card benefits? Sometimes, when you have many cards, you might forget to use a benefit. Keeping track of my benefits is one of the 5 reasons I love the CardPointers App. For instance, I get a $10 Dining Credit and a $10 Uber credit on my American Express Gold Card (effectively making my annual fee $10). When I open up the app and look under “offers”, it reminds me to use these credits.

Keeps Track of My Cards

I can look under “cards” in the bottom section, which will show all the cards I have. It also shows some of the very best categories for spending on each card. This is a quick reminder to me on how I can best use my cards. No more masking tape with category spends on my cards! It’s right on my phone.

Links Offers

We’ve talked about American Express offers in the past and they certainly have the most offers. Each of the transferable currencies has special offers too. If you sign up for the pro version ($40/yr), it will also keep track of the offers you can use. This can save you a ton of money!

Even more amazing, if you are online looking at a store that you have an offer for, it will come up as a popup to remind you to use that particular card and ensure you get that credit! This may be my very favorite feature! And you don’t even have to wade through all the offers – just add them all with one click and the app will let you know if there is a deal you can use on the site you are on. Talk about intuitive!! Here is info regarding the differences between the free and pro version. In my opinion, the potential in savings for the pro version makes it a no-brainer.

Bottom Line

I am not a fan of spending a lot of time with organization. Spreadsheets are not for me. Having apps makes credit card points and miles effortless. I’ve listed 5 reasons that I love the CardPointers App. If you think that you would enjoy this app too, use our link to save some money on the monthly or annual price. I hope you enjoy it as much as I do!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.