March 26, 2025

How I Earned Two Free Hyatt Nights By Paying My Taxes

Jess

One of the not-so-glamorous sides of self-employment is taxes. The only silver lining is being able to pay those taxes with a credit card! Here’s how I turned a large tax payment into two free nights at a luxury Hyatt property worth over $1,200.

Options to Pay With a Credit Card

You have two options when it comes to paying your taxes with a credit card: Pay1040 or ACI Payments, Inc.

You should also be aware that you can split a single tax payment between two cards, so if you’re working on a minimum spend for more than one card or trying to earn some perks through spend (like I was), then splitting the payment could make sense.

But the fee!

True, there is a fee for paying your taxes with a credit card, while there is no fee for paying by check or withdrawal from your bank account. But if the benefits of paying by card outweigh that fee, it’s a no-brainer!

If paying your taxes with a credit card allows you to meet minimum spending that you otherwise wouldn’t be able to meet, I’d say that’s definitely worth the fee. Or if the percentage back you earn from paying with a credit card is more than the fee then that’s another instance where paying with a credit card is the right move.

Neither of those was the case when I decided to pay my $15,000 tax bill with the World of Hyatt Credit Card. But here’s why I did it anyway.

All information about the World of Hyatt Credit Card has been collected independently by Travel Mom Squad. The World of Hyatt Credit Card is no longer available through Travel Mom Squad.

Why the World Of Hyatt Credit Card?

I’ve had my Hyatt card for years. So this wasn’t an instance where I’d be earning the welcome offer by charging my taxes to the card.

But one of the perks of the World Of Hyatt Credit Card is that you earn a category 1-4 free-night certificate after spending $15,000 on the card in a single calendar year.

Not only that, but I’ll still earn one Hyatt point on every dollar spent. That means a $15,000 tax payment = one category 1-4 free-night certificate + 15,000 Hyatt points. I was sold!

And you earn two qualifying elite-night credits towards Hyatt status for every $5,000 spent on the personal card. So I will also earn six elite nights towards maintaining Globalist status!

The Fee I Paid vs. What I’ll Earn in Return

A 1.85% credit card fee on a $15,000 tax payment totaled $277.50. Some of you may think that it’s outrageous to pay $277.50 to file taxes when you could pay by check for free. But for me, I came out way ahead!

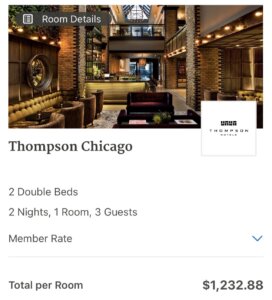

We were taking a road trip to Chicago last summer and wanted to stay at the Thompson Chicago. The Thompson was a Category 4 Hyatt property when we booked (though the Thompson is now a Category 5 Hyatt), and rooms regularly go for several hundred dollars a night. I realized that if I paid my taxes with my Hyatt card, I’d earn not only the category 1-4 free-night certificate but I’d also earn an additional 15,000 Hyatt points to put towards a second night at the Thompson. (Nights will range from 12,000-18,000 points/night depending on if they’re off-peak, standard, or peak nights.) You could put those 15,000 points towards even more free nights at a lower-category Hyatt!

I searched our dates to discover that the cash rate for two nights was over $1,200! Instead, we used the free-night certificate + points and paid a grand total of $0.

So yes, the $277.50 fee was worth what I’d earn in return and then some. And this doesn’t even include the value of those six elite-night credits towards maintaining Globalist status! I’d say I came out ahead.

Bottom Line

Don’t let the fee to pay taxes with a credit card stand in the way of an even better return! Of course, paying taxes with a credit card won’t make sense for everyone. But if you have a minimum spend to meet, have a card that earns more than the fee (like the card_name or the card_name), or want to take advantage of some perks that come with putting spend on a certain card, paying your taxes is a great option!

Related Posts

Paying Taxes With a Credit Card

It Can Be Worth It To Pay an Annual Fee

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Is this charge (ie paying your taxes with a credit card) treated as a cash advance where you will then owe interest on the day the charge hits your credit card?

I didn’t pay interest, just a fee for using the card.

I just did this last night! Split my tax bill between 2 cards and hit minimum spend on the 2 cards for over 140k UR points!