December 7, 2023

A Free Lunch with Credit Cards

Pam

With the benefits of credit card points and miles, it is possible to get a free lunch. Or dinner. Or breakfast. And not just in an airport lounge. Several credit cards have restaurant credits – I just realized that I am not using all of mine and thought that some of you may not be, either. Let’s go over how you can get a free lunch with credit cards today.

American Express Platinum Card

Uber Eats

This card comes with a credit for Uber or Uber Eats. One of my go-to monthly lunch deals is to go to Cafe Rio in my town and grab lunch when I am out running errands. This card gives you a $15 monthly credit and a bonus $20 credit for December for a total of $200/year. This helps bring down the cost of my annual fee to make it more palatable.

American Express Gold Card

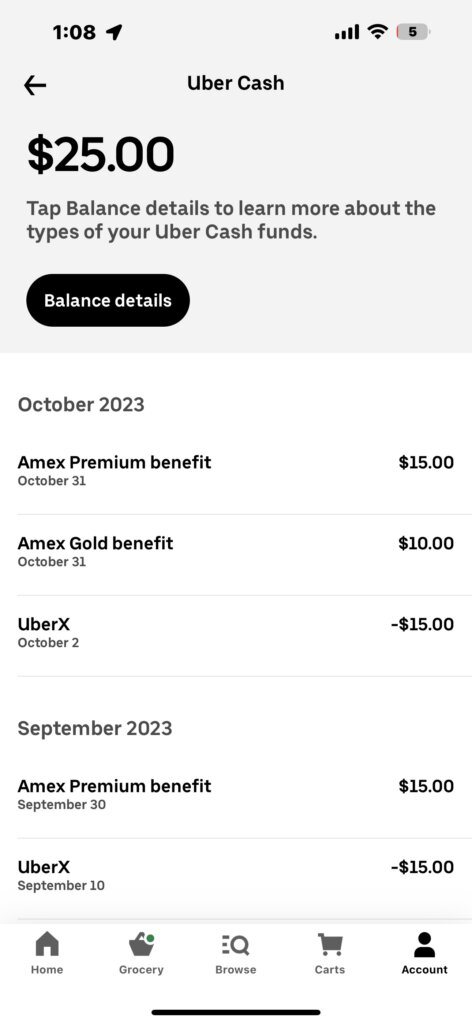

The American Express Gold Card also comes with the same credits but for $10/month. That means I have a total of $25 credit each month for Uber Eats between these two cards. Occasionally, I’ve used it for Uber travel, but not usually. And I always do pickup, so I don’t have to factor in delivery charges.

Here is my Uber Eats Account showing my $25 credit for November.

Grub Hub

You get $120/year or $10/mo for Grub Hub. It can also be used at Goldbelly, The Cheesecake Factory, Wine.com, Milk Bar, and participating Shake Shack locations, but I find it easier to use pickup and do Grub Hub. This is where I have been delinquent. Alex told me they were using this for their lunch between soccer games, and I haven’t been doing this. 😬 No more! I am taking advantage of this from now on!

American Express Business Gold Card

Grub Hub

Earn $20/mo for purchases at Grub Hub. This is a new benefit, and you have to enroll for it. Alex reminded me about it, so I plan to use it every month until I cancel this card. The annual fee on this card is $295, but using this benefit brings it down to $55, making it more manageable.

American Express Bonvoy Brilliant Card

You get $25/mo credit at ANY restaurant that you use your card at. This amounts to $300 per year, putting a dent in my high annual fee of $650 for this card. The only reason I keep this card is for the 85K annual certificate I get each year to use at a high-end Marriott property, making this a coupon book benefit, as Jess calls it. However, I love those luxury hotels, so I will keep it. I must remember to use this benefit for my husband and me to make the card worthwhile.

Bottom Line

As you can see, I’m not really getting a free lunch with these benefits since I am paying high annual fees for the benefit. They make that sting hurt less when I pay that annual fee for a card that I want to keep for many reasons. Each month, I have $105 to use for meals. The key is to remember to use these benefits to make your annual fees seem less! How are you doing with using your meal benefits?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Is there a link to sign up for the AMEX business gold Grub Hub benefit? I went to my P2’s Amex business gold account and didn’t see this benefit anywhere. Love your podcast!

https://global.americanexpress.com/card-benefits/detail/dining-credit/gold

So glad you enjoy the podcast!