August 7, 2023

Save on Travel Expenses With Bank Account Bonuses and Swagbucks

Pam

Credit card points and miles are great for paying for our flights and hotels. However, those are not the only vacation costs. There are still rental cars, food, and excursions to pay for. You can certainly book rental cars through a portal and pay for some excursions with the Capital One purchase eraser. To be honest, we don’t do either of those things as we prefer to save our points for flights or hotels. But as always, you do you. We have used a couple of other methods to pay for these expenses, though—bank account bonuses and swagbucks earnings. Let’s go over these today.

Bank Account Bonuses

If you have some disposable income, you can park money in a bank account for a certain period of time and they will “pay” you a bonus to try their bank out. I have made thousands in the past by doing this. You can read an entire article about this here. It is a very simple and lucrative way to earn money for those “extras” on a trip.

I suggest finding bonuses that don’t require a direct deposit as they are much simpler to do at first. Later on, you can decide if it is worth the time required to change your direct deposits from bank to bank.

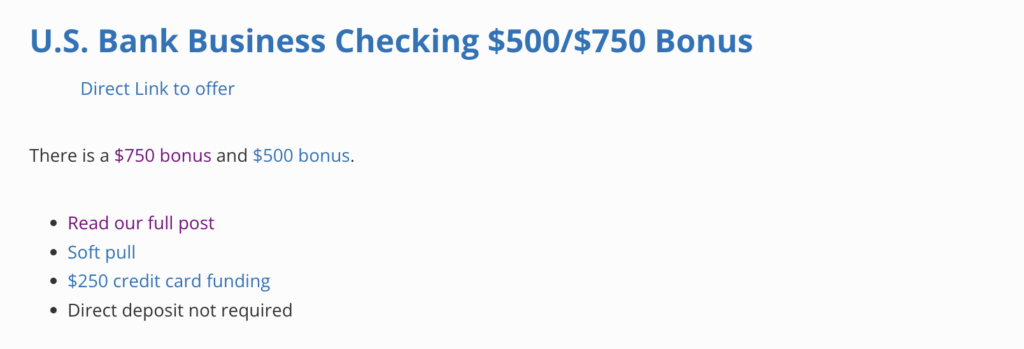

My favorite way to search for available bank account bonuses is through Doctor of Credit. They list the best checking and savings account bonuses for your area (and nationwide). These are updated monthly. There are many that are only available for first-time customers, so there comes a time when there may not be as many to apply for. Even though I have done many, I found this deal today that I could do:

I like that it is a soft pull, I can fund $250 on a credit card, and direct deposit is not required. You will always want to click “read our full post” to make sure it is a good fit for you. When I open the post, I learn I must do the following:

- Enroll In the U.S. Bank Mobile App or U.S. Bank Online Banking within 60 days of account opening.

- Use the special code when applying.

- Bonus:

- Earn $500 when you deposit $5,000

- Earn $750 when you deposit $15,000

- Make a new deposit(s) of at least $5,000 in new money deposits (Direct Deposits, ATM/Branch Deposits, Mobile Check Deposit, ACH, or Wires) within 30 days of account opening and thereafter maintain a balance of at least $5,000 until the 60th day after account opening.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Swagbucks

I have also earned thousands of dollars in gift cards with Swagbucks by trying out different services. Swagbucks also rewards new users by giving them a $10 bonus when they sign up and earn 2,500 SB within their first 60 days of joining. Once you achieve this milestone, your bonus will be awarded within one day after you qualify. You earn Swagbucks that can then be converted to Amazon gift cards, various travel gift cards, Target gift cards, restaurant gift cards, and even deposited into your PayPal account.

Some of the services that I have tried and earned extra savings on (above and beyond the cost of the service) have been:

- At-home food services such as Hello Fresh, Open Chef, and Sun Basket

- Chime bank

- Albert bank

- Acorns savings

- Varo Bank

You can also earn Swagbucks by doing surveys, but I don’t bother with that. Here is an article that talks about all the ways to earn Swagbucks. I like to look at the featured special offers to find deals.

When looking today, I found the following deals interesting:

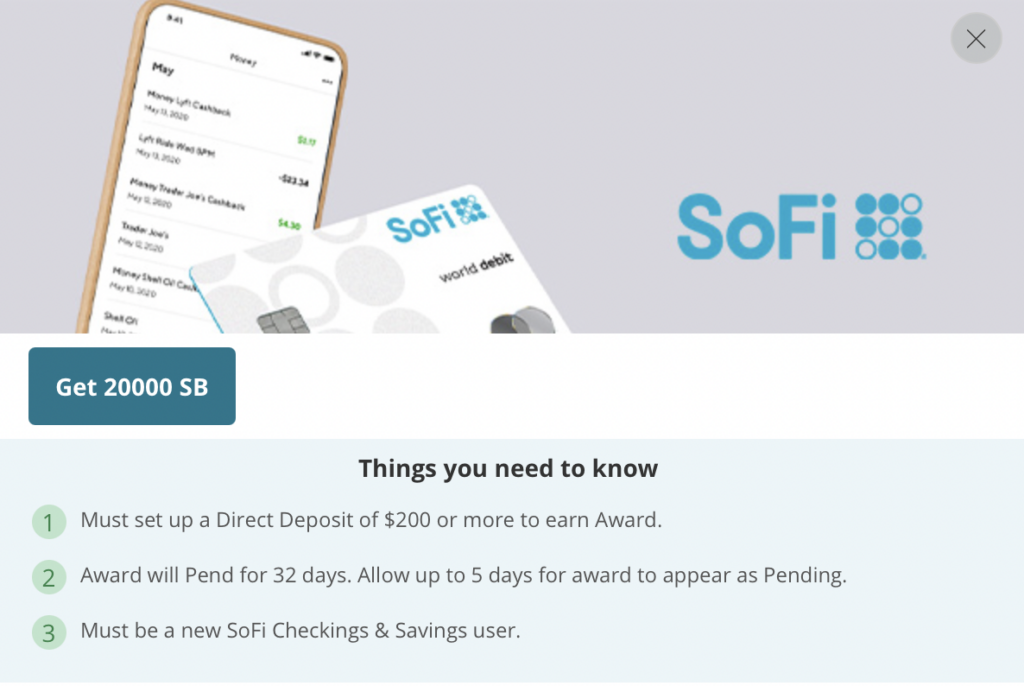

20,000 Swagbucks is worth $200—to learn about the terms and conditions, you would press the “Get 20000 SB” button.

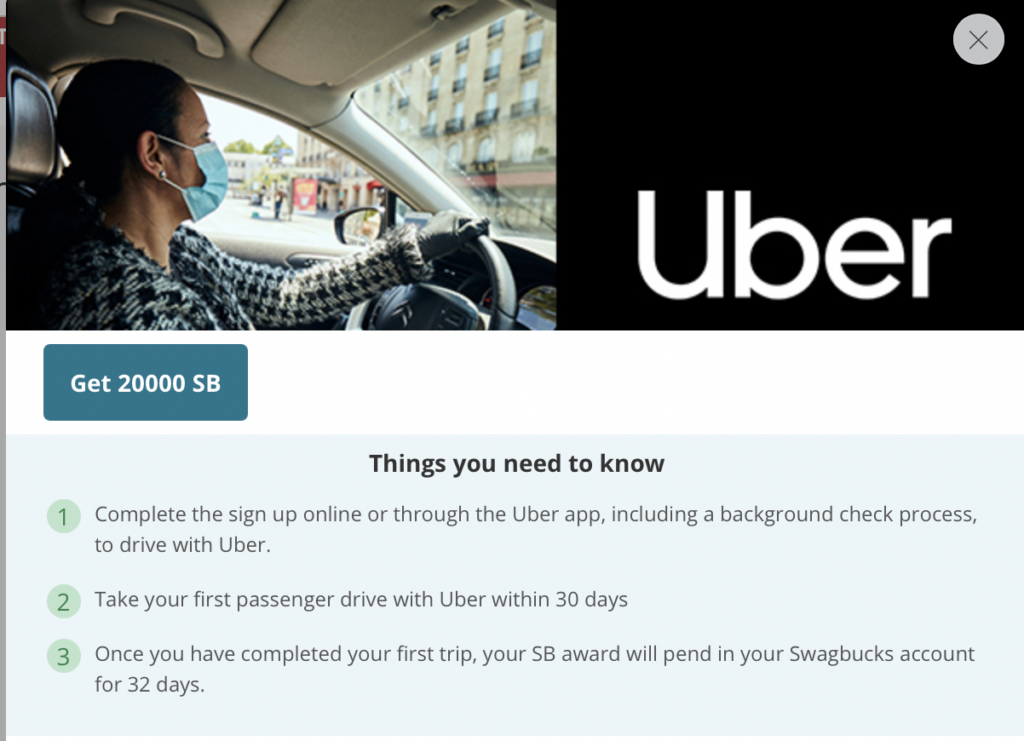

Want to make a quick $200? Become an Uber driver!

Earn an easy $15 gift card just by signing up for AARP (you don’t need to be retired).

Offers vary throughout the year. Sometimes they are great, sometimes they aren’t. It is important to take screenshots of offers you do as it doesn’t always track well. However, you can go to their customer care team and they usually can help you secure your Swagbucks.

Just like Rakuten, you can also earn cash back (although I would prefer to earn AMEX MR through Rakuten), and you can get some good deals as noted by the message that appeared when I was on today.

Bottom Line

I’ve earned money and gift cards by taking advantage of bank account bonuses and Swagbucks offers (that then help me save on items that aren’t covered by credit card points and miles). Have you used any of these methods to earn more money to spend on vacations?

Leave a Reply

Affiliate Disclosure: Travel Mom Squad uses affiliate links. We may receive compensation if you use our links when applying for a credit card at no extra cost to you. This compensation does not impact how or where products appear on this site. We have not reviewed all available credit card offers on this site. Thank you so much if you use our links!

Editorial Note: The editorial content on this site is not provided by credit card issuer. All opinions, reviews, and recommendations are expressed by the author, not the credit card issuer.

I also do fetch rewards and scan receipts for points and usually redeem them for restaurant gift cards and then use them on vacation for our family of 6. It really cuts down on the cost!

Thanks for sharing – I will check into that!

Loving it🙏🏼❣️