February 10, 2025

When Is the BEST Time to Get a New Credit Card?

Pam

One of the questions that beginner points enthusiasts ask the most is, “When is the best time to get a new credit card?” I really wish I had a magic ball that could foresee when a bonus is going to go higher so I could answer that question. I remember when I finally got under Chase 5/24. after being over for a while. I was able to get the card_name. My joy was palpable. I was able to refer my husband for the card so I got extra points for that too!

Yes, at times we will be disappointed that we miss out on an all-time high bonus offer. We have to be grateful we get as much free travel as we do! That is why it is important to take advantage of the high bonus offers when they are available! Each month we publish a post that talks about the best limited-time offers, so check it out when you are thinking about a new card!

Making Big Purchases

A great time to apply for a new card is before you have a big purchase coming up. My husband needed new tires on his truck and wanted a cover for the truck bed so we made sure to get a new credit card for him so we use those purchases to get a huge start on making his minimum spend.

My sister had some major dental expenses, so she opened up a new card for herself, and then for her husband. She will have a great welcome offer for a purchase she has to make anyway! Just by putting those expenses on new credit cards, she was able to use those points to book a business-class seat for a trip to Europe! This is what points and miles are all about. You earn miles for free travel while making everyday purchases you have to make anyway.

Get a new credit card before you buy new tires!

Growing a Stockpile

We are huge proponents of having a stockpile of points. That way, when you feel like traveling, you’re able to go for it. Once, when I was at Alex’s, we looked at the snow and wished we were in Hawaii. I mentioned that we had stockpiles of points and should just go. We were in Maui a week later!

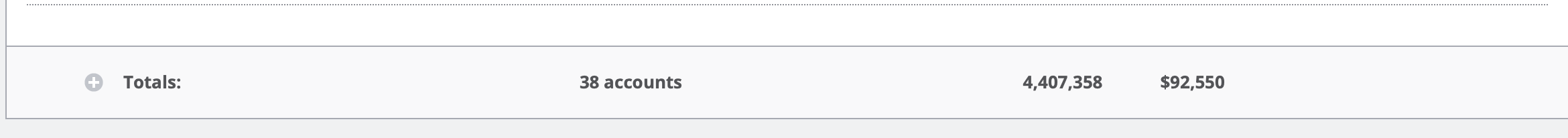

If you want to grow a stockpile, the best time to get a new card is when you are close to meeting the minimum spend on your current card. We are almost always getting new cards and growing our stockpiles. Here’s a peek at my stockpile from a couple years ago (remember these are my husband’s and mine and hotels, airline, and transferable points):

The secret is to keep applying and keep learning. With our help, you, too, can grow a hefty stockpile of points and miles! I don’t worry much about category spending, preferring to work on new minimum spending for new cards. That is how you build up a LOT of points and miles.

Saving For a Dream Trip

Another time to apply for a new card is when you first start planning your own dream trip. Where do you want to go? What credit cards do you need to make that trip happen? How can you save money with points and miles? We are here to help you. Not sure what card to get next? Ask for a free credit card consultation!

Make that dream trip happen with points and miles!

Bottom Line

Don’t hesitate to apply when you see a high offer for a credit card that you are interested in. But don’t try to second guess when that best time to get a credit card occurs. We get some high offers; we get some lower offers. Rest assured, we will let you know when a good offer comes up. We can’t wait to see where credit card points and miles take you!

Related Posts

Don’t Wait for That Elevated Welcome Offer

Using Points and Miles When You Don’t Have a Plan of Where to Go

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.